This amazing little video charts the location of every asteroid discovered since 1980. As we move into the 1990s, the rate of discovery picks up quite dramatically because we’re now working with vastly improved sky scanning systems. And that means that you will especially want to watch the second half of the video. Below the jump, I’ve pasted some more information that explains what you’re seeing. Thanks to @WesAlwan and Mike for sending this great little clip our way.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

Is Social Entrepreneurship a Better Space than Tech for Women?

There has been an explosive conversation in the blogosphere this

weekend about the under representation of women in tech entrepreneurship

and web entrepreneurship more broadly. Is the situation better in

social entrepreneurship?

There has been an explosive conversation in the blogosphere this

weekend about the under representation of women in tech entrepreneurship

and web entrepreneurship more broadly. Is the situation better in

social entrepreneurship?

This iteration of the conversation started off with a piece in the Wall Street Journal that rehashed many of the back-and-forths on this issue from the last few months, including the debate around whether the forthcoming TEDWomen conference was actually a step back for gender equality because of a sort of "seperate-but-(un)equal" thing. It also included a pretty lazy potshot at Techcrunch, the leading web 2.0 media publication.

Michael Arrington, the founder of Techcrunch, didn't like that one much at all and wrote a post titled: "Too Few Women in Tech? Stop Blaming the Men." In it, he effectively argues that venture investors, tech conferences and the media clamor for female entrepreneurs because they're eager to redress the imbalance and highlight more female innovators in order to inspire a younger generation of women to build companies.

The Relationship Between IP, Technology Transfer, and Development

In order to better understand the link between intellectual property rights, technology transfer and development, an analysis was recently conducted of the expectations of developing countries, particularly in sub-Saharan Africa, of technology transfer. The analysis shows that in order to foster development through technology, it is necessary to put into place an efficient and flexible intellectual property rights system and to promote local innovation.

In order to better understand the link between intellectual property rights, technology transfer and development, an analysis was recently conducted of the expectations of developing countries, particularly in sub-Saharan Africa, of technology transfer. The analysis shows that in order to foster development through technology, it is necessary to put into place an efficient and flexible intellectual property rights system and to promote local innovation.

This study draws on research and on answers to a questionnaire sent to regional universities and research and development centres.

Venture Capital Trends – Google Finds More Venture Capital News But Less Interest in Venture Capital?

For the latest high growth private company financing news & data, sign up for the free CB Insights newsletter or follow us @cbinsights on Twitter. You can also access CB Insights’ data for free.

The CB Insights team likes data and so on occasion, we examine other credible, external data sources. We recently looked at Google Trends to see what it might suggest about what it suggests is happening with venture capital based on search volume trends. The results as you’ll see below are counter-intuitive.

Globally, news related to venture capital has increased while search volume for the term “venture capital” has seemingly decreased as can be seen below.

8 Advantages of Incorporating a Business

Incorporating a business is not difficult it can be done online or physically. Anyone who has a business can incorporate his business irrespective of size. There are many types of corporations available in the US so before you incorporate your business learn about the different kinds of business structures available in the US. You must also find out what the advantages and disadvantages of incorporating business in different states are. Incorporation of a business can be handled by a qualified lawyer or professional incorporating services. The main document that has to be filed for incorporating a business is known as the ‘articles of incorporation.” And, filing fees need to be paid to appropriate state agencies.

Incorporating a business is not difficult it can be done online or physically. Anyone who has a business can incorporate his business irrespective of size. There are many types of corporations available in the US so before you incorporate your business learn about the different kinds of business structures available in the US. You must also find out what the advantages and disadvantages of incorporating business in different states are. Incorporation of a business can be handled by a qualified lawyer or professional incorporating services. The main document that has to be filed for incorporating a business is known as the ‘articles of incorporation.” And, filing fees need to be paid to appropriate state agencies.

Incorporating a business has several advantages. Even if your operation is a single person one forming a corporation means creating a separate legal entity which is a separate individual. According to business gurus incorporating is a must as it:

1. Protects the owners from personal liabilities. This means you and your family or partners will not be legally liable for any business related payments in case of debt. Incorporating a business protects your home and personal assets from risks.

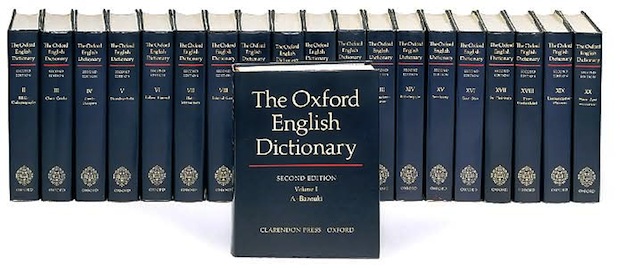

Latest Victim of the Internet: The Oxford English Dictionary

The Oxford English Dictionary, currently a 20 volume, 750-pound

monstrosity, has been the authoritive word on the words of the English

language for 126 years. The OED3, the first new edition since 1989, may

also be the first to forgo print entirely, reports the AP.

The Oxford English Dictionary, currently a 20 volume, 750-pound

monstrosity, has been the authoritive word on the words of the English

language for 126 years. The OED3, the first new edition since 1989, may

also be the first to forgo print entirely, reports the AP.

The Internet is on a physical-media-killing rampage. First BlockBuster, now the venerable OED?

Nigel Portwood, chief executive of the Oxford University Press (isn't that the perfect name for him?), says online revenue has been so high that it is highly unlikely that the third edition of the OED will be physically printed. The full 20-volume set costs $995 at Amazon, and of course it requires supplementals regularly to account for valuable words like "bootylicious."

What Is That VC Really Thinking During Your Pitch?

For entrepreneurs seeking venture capital, the pitch is everything.

For entrepreneurs seeking venture capital, the pitch is everything.

Most investments in a start-up company, from the smallest “seed” financing that may be based on little more than an idea for a start-up, to a $50 million round for a profitable company preparing to go public, is preceded by an entrepreneur standing in a room explaining why venture capitalists should part with their money.

We asked Brian Jacobs, general partner with Emergence Capital Partners, a San Mateo, Calif.-based technology investor that is investing out of a $200 million fund raised in 2007, to take us behind the scenes of a typical company pitch and explain what goes through the mind of an investor as he’s watching and listening.

The slides below are a selection from an actual presentation made by Emergence Capital portfolio company InsideView Inc., a San Francisco-based company selling software that helps salespeople find new clients, improve existing relationships and close deals. The information is customized for each user and is provided through a Web-crawling search engine that finds and filters potentially important sales leads and information from in new social media sites and other emerging data sources. The presentation was shown to new investors, but eventually the company chose to accept the insiders’ investment proposal which resulted in an $11.5 million insider Series B financing in April from Emergence Capital, Rembrandt Venture Partners and Greenhouse Capital Partners. The company has now raised more than $25 million.

Young entrepreneur gets some recognition and some help for college

DENVER, Pa. - Zachary Gosling, 18, will begin majoring in business at Drexel University next month but is already quite the businessman.

DENVER, Pa. - Zachary Gosling, 18, will begin majoring in business at Drexel University next month but is already quite the businessman.

In first grade, he sold rocks from his driveway to unwitting classmates, claiming that he had spiffed them up in a "rock cleaner."

At age 8, he opened his first Scottrade account.

But his real coup came at 13, when he launched an online auction website from his bedroom in rural Denver, Pa., near Lancaster, supported by advertising and sponsorships rather than the fees charged by giant auction sites. The site got as many as five million page views per quarter just two years later. Had it not been sabotaged by hackers, its exponential rise might have given eBay pause.

The book of blunders

There’s hardly a worker on Earth who hasn’t mused of running his own company, calling his own shots and freeing himself from the yoke of his middling, Celine Dion-loving immediate supervisor.

There’s hardly a worker on Earth who hasn’t mused of running his own company, calling his own shots and freeing himself from the yoke of his middling, Celine Dion-loving immediate supervisor.

For most, it’s just a fantasy. But for some — those brave folk we call entrepreneurs — starting a business stops being a pipe dream and turns into a full-time reality.

The risks are grave, and there’s little room for error. Though statistics vary, they all indicate it’s better than even money an entrepreneurial enterprise will go belly up within a year.

And while some of those ill-fated dreamers may be finding innovative ways to blow it, many are making mistakes straight from the Book of Common Blunders. So before you punt your old life away to pursue the dream of selling a solar flashlight, you need to know what they are.

Top 10 Women in Biotech

It's a well-worn cliché that men dominate the top ranks of the biotech industry. But over the past decade a group of extraordinary women has put that cliché to the test. Perhaps one of the most interesting aspects of our selection of 10 women who have excelled in the industry is that there were so many outstanding women in biotechnology to choose from.

It's a well-worn cliché that men dominate the top ranks of the biotech industry. But over the past decade a group of extraordinary women has put that cliché to the test. Perhaps one of the most interesting aspects of our selection of 10 women who have excelled in the industry is that there were so many outstanding women in biotechnology to choose from.

One of this year's group runs a large cancer drug business. One not only founds biotech companies, she also places some savvy venture bets on future stars. Several are CEOs pursuing excellent science and top clinical trial prospects. Some came up through the scientific ranks, others through the business development side of the business.

Live TV Is For Old People: Time Shifting And Online Make Up Nearly Half Of All Viewing

Between online video, DVRs, and on-demand cable the amount of time

people spend watching live TV (you know, with all of those commercials

that advertisers spend $70 billion a year on) is shrinking fast. Only

52 percent of American’s viewing time is spent on live TV compared to

online and time-shifting alternatives, according to a new survey of

1,000 American consumers by market research firm Morpace.

And that percentage decreases the younger the audience, with the key

18-to-34-year-old demographic watching live TV only 41 percent of the

time, versus 64 percent of the time for those 55 and older.

Between online video, DVRs, and on-demand cable the amount of time

people spend watching live TV (you know, with all of those commercials

that advertisers spend $70 billion a year on) is shrinking fast. Only

52 percent of American’s viewing time is spent on live TV compared to

online and time-shifting alternatives, according to a new survey of

1,000 American consumers by market research firm Morpace.

And that percentage decreases the younger the audience, with the key

18-to-34-year-old demographic watching live TV only 41 percent of the

time, versus 64 percent of the time for those 55 and older.

From WISH 2010 In Tokyo: 15 Japanese Startups Demo Their Services

On Saturday, I attended WISH 2010

in Tokyo (where I live) to see a total of 15 Japanese startups

presenting their services onstage to a panel of judges and an audience

of 550 people. The event was organized by online marketing company Agile Media Network (“Japan’s Federated Media“).

On Saturday, I attended WISH 2010

in Tokyo (where I live) to see a total of 15 Japanese startups

presenting their services onstage to a panel of judges and an audience

of 550 people. The event was organized by online marketing company Agile Media Network (“Japan’s Federated Media“).

Eight of the companies won prizes from various national media (i.e. TechCrunch Japan), and there was one big winner (an e-book publishing platform called Puboo). But here are thumbnail sketches of all of the companies that presented at WISH 2010. (Please note that not all of these services are available in English.)

Here’s the best way to value your startup

A reader asks: I’m the founder of a mobile apps startup, and we’re starting to get some incredible traction. I’ve been bootstrapping the venture for the last year, but I’d really like to raise about $2 million to scale this thing. If a VC invests $2 million, what percentage of the company will he own?

A reader asks: I’m the founder of a mobile apps startup, and we’re starting to get some incredible traction. I’ve been bootstrapping the venture for the last year, but I’d really like to raise about $2 million to scale this thing. If a VC invests $2 million, what percentage of the company will he own?

Answer: It depends upon the value of your company prior to the investment (commonly referred to as the “pre-money valuation” or “pre”). The VC’s percentage ownership is calculated by dividing the amount of its investment by the post-money valuation of the company (which is equal to the pre plus the amount of the investment).

For example, if the pre were $4 million, the VC would get one-third ($2,000,000 divided by $6,000,000); on the other hand, if the pre were $1 million, the VC would get two-thirds ($2,000,000 divided by $3,000,000).

PIPELINE Entrepreneurial Immersion Program Opens Applications for 2011 Fellowship

The PIPELINE technology entrepreneur fellowship program opened applications for its 2011 fellowship today. Now in its fourth year of operations, the Kansas-based PIPELINE Entrepreneurial Fellowship Program is a nationally-acclaimed leader in the field of entrepreneurial development for high growth entrepreneurs.

The PIPELINE technology entrepreneur fellowship program opened applications for its 2011 fellowship today. Now in its fourth year of operations, the Kansas-based PIPELINE Entrepreneurial Fellowship Program is a nationally-acclaimed leader in the field of entrepreneurial development for high growth entrepreneurs.

PIPELINE is an “immersion program” which blends the best techniques from the fields of leadership training, business coaching and venture capital, and the latest thinking from America’s leading entrepreneurial experts. It combines these ingredients with extensive network building for the Pipeline fellows – and helps them to develop strong peer networks to support them over the course of their entire career.

Download the PDF

5 Ways Tech Startups Can Disrupt the Education System

"Revolutionary." "Disruptive." These terms are used with such

frequency that they may have lost much of their meaning. That's not to

say that there aren't plenty of products and services that are

innovative, and plenty of systems, plenty of organizations that are ripe

for disruption or "revolution." Take education, for example. Our

modern education system is, after all, not so modern, with many of its

practices strongly rooted in a "factory" model circa the Industrial

Revolution. But what does revolutionizing education really look like?

And which startups working in education technology are really

"disruptive"?

"Revolutionary." "Disruptive." These terms are used with such

frequency that they may have lost much of their meaning. That's not to

say that there aren't plenty of products and services that are

innovative, and plenty of systems, plenty of organizations that are ripe

for disruption or "revolution." Take education, for example. Our

modern education system is, after all, not so modern, with many of its

practices strongly rooted in a "factory" model circa the Industrial

Revolution. But what does revolutionizing education really look like?

And which startups working in education technology are really

"disruptive"?

A recent thread on Quora bypasses the "revolutionary" and "disruptive" adjectives, asking instead "What are some interesting startups in the education space?" But a recent blog post at The Teaching Master does invoke these adjective, listing the "Top 25 Web Startups Revolutionizing Teaching." Neither the Quora nor the Teaching Master post offer metrics. There's no indication of what makes a "top" startup or what constitutes "interesting," let alone "revolutionary" work in the ed-tech space.

Will Biofuels Go Mainstream?

Cheap, plentiful biofuels could ameliorate a host of global problems:

carbon emissions, trade imbalances, agricultural employment in the

middle of the country and in emerging nations.

Cheap, plentiful biofuels could ameliorate a host of global problems:

carbon emissions, trade imbalances, agricultural employment in the

middle of the country and in emerging nations.

And there is no doubting the demand. The world consumes the

equivalent of 1.06 cubic miles of oil globally a

What Do You Think the Future of the Workplace Will Look Like?

We kicked off the week last Monday with an article on improving IT worker morale.

This week we'd like to get your thoughts on what changes we'll see in

the workplace of the future, both good and bad. For example, earlier

this month Gartner released a list of ten changes the workplace will see in the next 10 years. What do you think about Gartner's list, and what changes do you expect to see?

We kicked off the week last Monday with an article on improving IT worker morale.

This week we'd like to get your thoughts on what changes we'll see in

the workplace of the future, both good and bad. For example, earlier

this month Gartner released a list of ten changes the workplace will see in the next 10 years. What do you think about Gartner's list, and what changes do you expect to see?

What A CEO Does

I am posting this as a MBA Mondays

post. But I did not learn this little lesson at business school. I

learned it from a very experienced venture capitalist early in my

post-MBA career.

I am posting this as a MBA Mondays

post. But I did not learn this little lesson at business school. I

learned it from a very experienced venture capitalist early in my

post-MBA career.

I was working on a CEO search for one of our struggling portfolio comapnies. We had a bunch of them.

I started in the venture capital business just as the PC hardware bubble of the early 80s was busting. Our portfolio was a mess. It was a great time to enter the business. I cleaned up messes for my first few years. I learned a lot.

Ten Things Your Employees Wish You Knew About Them

If you think it's tough being a manager these days, try being an employee. Most are in the position of having to go with the flow because of the current economic conditions. But that doesn't necessarily mean they do so with a smile on their face. Here are ten things your employees wish you knew about them:

If you think it's tough being a manager these days, try being an employee. Most are in the position of having to go with the flow because of the current economic conditions. But that doesn't necessarily mean they do so with a smile on their face. Here are ten things your employees wish you knew about them:

1. They are happy to have a job. But that doesn't necessarily mean they are happy in their job. Big difference. People who are happy in their jobs act a lot different than those grateful to have a job. They are highly engaged and will do whatever it takes to delight the customer. The other group simply floats along praying for the day they can tell you really what they are thinking. Most likely they will do this as they hand in their notice. That is if they even give notice.

The State of Entrepreneurship in Chile

The Chilean economy has been recognized as the most competitive of Latin America. In general, Chile has been characterized by political and economic stability and relatively low levels of corruption and offers one of the most advanced physical infrastructure systems in the region. The potential and proven track record of this economy has led to Chile’s recent accession to the OECD as its 31st member and its first member in South America. Not surprisingly, Chile is often a case study in economic development. The question is whether its model will show the power of entrepreneurship as an engine for prosperity?

The Chilean economy has been recognized as the most competitive of Latin America. In general, Chile has been characterized by political and economic stability and relatively low levels of corruption and offers one of the most advanced physical infrastructure systems in the region. The potential and proven track record of this economy has led to Chile’s recent accession to the OECD as its 31st member and its first member in South America. Not surprisingly, Chile is often a case study in economic development. The question is whether its model will show the power of entrepreneurship as an engine for prosperity?

Unfortunately, Chile is not yet a startup culture, and innovation still plays a minor role in the creation of new enterprises, according to the infoDev Incubator Support Center (iDisc) service from the World Bank. This may come as surprise since the Chilean government’s investment in R&D has increased 70% since 2005 and much of it has flown into universities. It has also created the InnovaChile program to support innovation in various sectors, including biotechnology, energy and ITC. The slow pace of innovation in Chile calls for programs and policies that unlock the transfer of R&D into innovations that can be commercialized. Some experts believe that much of the bottleneck lies in the very weak links between Chilean universities and businesses but as Kauffman research has shown, this is a complex piece of the puzzle to make work.