Did you know that there are over 1.5 million non-profits in operation

in the U.S. which accounts for a staggering 8.11% of all wages paid in

the U.S. (Source: National

Center for Charitable Statistics).

Did you know that there are over 1.5 million non-profits in operation

in the U.S. which accounts for a staggering 8.11% of all wages paid in

the U.S. (Source: National

Center for Charitable Statistics).

If you are passionate

about a cause and can find a like-minded group of people to help you

share the significant responsibilities of operating a non-profit, then

the philanthropic and entrepreneurial rewards can be significant – if

you know what you are doing.

Starting a non-profit is very similar

to starting a for-profit business – and requires a solid understanding

of business planning, tax law, marketing, financing options and

leadership.

Here is a basic checklist for how to start

a non-profit organization (NPO), while ensuring you pay attention to

important legal and regulatory processes:

1. Define

Your Mission

To ensure that everyone is singing off the

same hymn sheet, it’s critical that you define your mission statement,

(i.e. the purpose of your non-profit and the need it addresses) early on

in the start-up phase. At the same time, realize that it will evolve

over time as other stakeholders take shape and provide input – so keep

your mission statement reasonably high level for now.

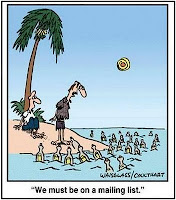

There have been quite a few posts written about this meme in the past

few weeks.

There have been quite a few posts written about this meme in the past

few weeks.

Did you know that there are over 1.5 million non-profits in operation

in the U.S. which accounts for a staggering 8.11% of all wages paid in

the U.S. (Source:

Did you know that there are over 1.5 million non-profits in operation

in the U.S. which accounts for a staggering 8.11% of all wages paid in

the U.S. (Source:  What ails Europe’s innovation machine? Bureaucratic procedures are high on the list, as is the EU’s intellectual property framework, according to a new survey of European Union and Brussels opinion leaders commissioned by GE.

What ails Europe’s innovation machine? Bureaucratic procedures are high on the list, as is the EU’s intellectual property framework, according to a new survey of European Union and Brussels opinion leaders commissioned by GE. If the EU is to meet its targets for cutting greenhouse gas emissions, integrating renewable energy sources, and being more energy efficient - while at the same time guaranteeing energy security - its electricity transmission system needs a fundamental and far-reaching modernisation.

If the EU is to meet its targets for cutting greenhouse gas emissions, integrating renewable energy sources, and being more energy efficient - while at the same time guaranteeing energy security - its electricity transmission system needs a fundamental and far-reaching modernisation. There has been a huge drop in venture capital activity in the UK over the past two years, with the number of exits falling by 40 per cent and the total amount of VC raised falling by 50 per cent, according to new research by the National Endowment for Science, Technology and the Arts (NESTA).

There has been a huge drop in venture capital activity in the UK over the past two years, with the number of exits falling by 40 per cent and the total amount of VC raised falling by 50 per cent, according to new research by the National Endowment for Science, Technology and the Arts (NESTA).

Dear SBIR Gateway Insider,

Dear SBIR Gateway Insider, Venture capitalists are typically some of the most optimistic people on the planet, touting how new technologies will change the world. But ask American VCs about their own industry and that optimism just flies out the door. A new survey finds that more than 90 percent of U.S. venture capitalists expect the number of venture firms to decline in the next five years. That's hardly a vote of confidence, but it speaks to the big challenges facing an industry suffering from weak returns and lackluster exits.

Venture capitalists are typically some of the most optimistic people on the planet, touting how new technologies will change the world. But ask American VCs about their own industry and that optimism just flies out the door. A new survey finds that more than 90 percent of U.S. venture capitalists expect the number of venture firms to decline in the next five years. That's hardly a vote of confidence, but it speaks to the big challenges facing an industry suffering from weak returns and lackluster exits.

Austin holds a handful of top rankings in innovation, intelligence, friendliness, fitness and environmentalism, but what about in terms of business, real estate, and the economy?

Austin holds a handful of top rankings in innovation, intelligence, friendliness, fitness and environmentalism, but what about in terms of business, real estate, and the economy?

One prefers the unknown, the other can’t stand it. Now more than ever, we have to find a way to get along.

One prefers the unknown, the other can’t stand it. Now more than ever, we have to find a way to get along.

Trilliant

Trilliant

If you're like many of today's angel and venture funded companies, you are doing more with less and your team is distributed hither and yon. Your programmers are in India, your test team in Guatemala, and your sales force in 5 cities across the U.S. Even your management team is spread between Portland, San Francisco and Seattle.

If you're like many of today's angel and venture funded companies, you are doing more with less and your team is distributed hither and yon. Your programmers are in India, your test team in Guatemala, and your sales force in 5 cities across the U.S. Even your management team is spread between Portland, San Francisco and Seattle. If the electric car is to succeed, it needs charging stations that

are both easy-to-use and well designed--a clunky infrastructure will

quickly turn off potential drivers. That's why GE brought in

If the electric car is to succeed, it needs charging stations that

are both easy-to-use and well designed--a clunky infrastructure will

quickly turn off potential drivers. That's why GE brought in  The 22 statistics that you are about to read prove beyond a shadow of

a doubt that the middle class is being systematically wiped out of

existence in America.

The 22 statistics that you are about to read prove beyond a shadow of

a doubt that the middle class is being systematically wiped out of

existence in America.