Kiplinger, font of finance advice, business forecasts and informational analysis, has released its annual "Best Cities" for the next decade list. But despite its focus on money, Kiplinger did not solely base its research on average annual incomes, salary hikes, or cost of living. Although those monetary issues are major concerns in choosing a city for living, people need more. They need art and culture, education and innovation. And these days, riddled by the economic and environmental concerns that plague large metropolitan areas, cities offering of out-of-the-box solutions also draw residents.

Kiplinger, font of finance advice, business forecasts and informational analysis, has released its annual "Best Cities" for the next decade list. But despite its focus on money, Kiplinger did not solely base its research on average annual incomes, salary hikes, or cost of living. Although those monetary issues are major concerns in choosing a city for living, people need more. They need art and culture, education and innovation. And these days, riddled by the economic and environmental concerns that plague large metropolitan areas, cities offering of out-of-the-box solutions also draw residents.

Kiplinger thought of all these aspects in creating their list.

In our search for top destinations for your future, we focused on cities where governments, universities and business communities work together to supercharge the economic engine. And it is no coincidence that economic vitality and livability go hand in hand.

Creativity in music, arts and culture, plus neighborhoods and recreational facilities that rank high for coolness attract like-minded professionals who go on to cultivate a region's business scene. All of which make our 2010 Best Cities not just great places to live but also great places to start a business or find a job.

As

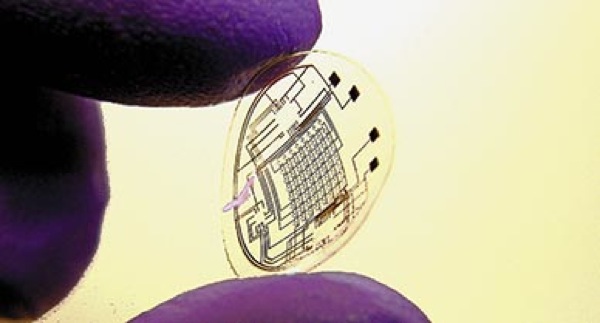

As  Display screens integrated into contact lenses (image above)?

Micromechanical medical devices? Pervasive biosensors? A big challenge

in the development of wearable and implantable gadgets is how to power

them. Years ago, I wrote about efforts to develop a "

Display screens integrated into contact lenses (image above)?

Micromechanical medical devices? Pervasive biosensors? A big challenge

in the development of wearable and implantable gadgets is how to power

them. Years ago, I wrote about efforts to develop a " Got balls, got money, and madly in love with promising startups?

Got balls, got money, and madly in love with promising startups?

The majority of chief executives at privately held technology

companies expect to receive bonuses this year, according to

The majority of chief executives at privately held technology

companies expect to receive bonuses this year, according to  Kauffman Labs for Enterprise Creation

Kauffman Labs for Enterprise Creation

For more than a year, I’ve been writing that the U.S. financial ecosystem for venture capital-backed startups is crumbling and placing the U.S economy in jeopardy at a time when countries such as China and India are producing far more sophisticated startups than ever. For so long, it seemed that these concerns fell on deaf ears.

For more than a year, I’ve been writing that the U.S. financial ecosystem for venture capital-backed startups is crumbling and placing the U.S economy in jeopardy at a time when countries such as China and India are producing far more sophisticated startups than ever. For so long, it seemed that these concerns fell on deaf ears. New technologies and a growing capacity for innovation are playing fundamental roles in the search for answers to the current economic situation. At the Wharton Global Alumni Forum in Madrid, three executives from Spain's high-tech sector and two entrepreneurs in Africa's growing technology sector took part in a panel session titled, "Technology and Innovation: Panaceas or Chimeras?" The session was moderated by Alberto Durán, founder and CEO of Rio de Janeiro-based Mundivox Communications.

New technologies and a growing capacity for innovation are playing fundamental roles in the search for answers to the current economic situation. At the Wharton Global Alumni Forum in Madrid, three executives from Spain's high-tech sector and two entrepreneurs in Africa's growing technology sector took part in a panel session titled, "Technology and Innovation: Panaceas or Chimeras?" The session was moderated by Alberto Durán, founder and CEO of Rio de Janeiro-based Mundivox Communications. 2007. That's the last time we saw any true innovation in mobile hardware. That's the year that the first iPhone was introduced. Here, we are now, three years and three versions of the iPhone later and we've seen no significant innovations in mobile hardware. Sure, we've seen cameras with better resolution and faster processors, but those are just natural evolutions of technology that would be happening anyway. There has been no innovative development of hardware (or it's interactions) since that first iPhone set the new standard for mobile devices and how we use them.

2007. That's the last time we saw any true innovation in mobile hardware. That's the year that the first iPhone was introduced. Here, we are now, three years and three versions of the iPhone later and we've seen no significant innovations in mobile hardware. Sure, we've seen cameras with better resolution and faster processors, but those are just natural evolutions of technology that would be happening anyway. There has been no innovative development of hardware (or it's interactions) since that first iPhone set the new standard for mobile devices and how we use them.

You, too, can meet a venture capitalist.

You, too, can meet a venture capitalist.

Spain’s victory yesterday in the World Cup in Johannesburg marks the conclusion to an exciting competition. However, with the media pointing to some of the dashed economic expectations among South Africans these past few weeks, I decided to inquire a little more into the entrepreneurial part of South Africa’s economic development equation which led me to uncover some important trends and opportunities suggesting that the country might be well on its way to achieving the goal set forth by the country’s new president, Jacob Zuma, to create 4 million new jobs by 2014.

Spain’s victory yesterday in the World Cup in Johannesburg marks the conclusion to an exciting competition. However, with the media pointing to some of the dashed economic expectations among South Africans these past few weeks, I decided to inquire a little more into the entrepreneurial part of South Africa’s economic development equation which led me to uncover some important trends and opportunities suggesting that the country might be well on its way to achieving the goal set forth by the country’s new president, Jacob Zuma, to create 4 million new jobs by 2014.