Given the sheer amount of quirky holidays in existence, it's no wonder so many people forget about the ones that are truly important. Green holidays serve to promote awareness of the issues affecting our environment and the actions that need to be taken in order to preserve it. Celebrating and observing, say, Arbor Day is an excellent way to bond with fellow green geeks who share your concern for the Earth while actually making the world a greener place. Here are eight essential green holidays.

Given the sheer amount of quirky holidays in existence, it's no wonder so many people forget about the ones that are truly important. Green holidays serve to promote awareness of the issues affecting our environment and the actions that need to be taken in order to preserve it. Celebrating and observing, say, Arbor Day is an excellent way to bond with fellow green geeks who share your concern for the Earth while actually making the world a greener place. Here are eight essential green holidays.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

Leveraging Social Assets

We all possess assets whether owned, controlled or used to produce more value. Businesses consider human capital as an asset. Have you ever heard a business manager express an individual’s value as an asset to the organization?

We all possess assets whether owned, controlled or used to produce more value. Businesses consider human capital as an asset. Have you ever heard a business manager express an individual’s value as an asset to the organization?

Organizations leverage human capital to produce economic gain. Organizations produce products and services considered as assets for consumption in exchange for economic return. Human capital is used to create, distribute and exchange the organizational assets for economic gains.

Collectively organizational and individual assets are often underutilized. Underutilized assets represent significant value yet realized or optimized to their fullest potential.

Creating The Social Value Index

Social currency represents information shared which encourages further social encounters and each encounter creates social value. Social currency, and the value it represents, is a social system which points to financial gains created by innovation. Part of the innovation we are witnessing is people are learning to leverage assets by reducing friction then exchanging new value with others like never before.

Social currency represents information shared which encourages further social encounters and each encounter creates social value. Social currency, and the value it represents, is a social system which points to financial gains created by innovation. Part of the innovation we are witnessing is people are learning to leverage assets by reducing friction then exchanging new value with others like never before.

What is a Leveraged Asset?

We all possess assets whether owned, controlled or used to produce more value. Businesses consider human capital as an asset. Have you ever heard a business manager express an individual’s value as an asset to the organization?

You Are a Data Factory

Data drives everything we know and don’t yet know. Every time we type an email, dial a number, add a tweet or publish content we are adding data to the “network” and that data carries meaning and meaningful indicators of behavior.

Data drives everything we know and don’t yet know. Every time we type an email, dial a number, add a tweet or publish content we are adding data to the “network” and that data carries meaning and meaningful indicators of behavior.

Data is exploding faster than most imagine and with explosive growth organizations, people and machines are learning more about human behavior and people’s preferences faster than ever before.

Moore’s law states that the amount of digital information increases tenfold every five years. The social web is accelerating data. According to Cisco by 2013 the amount of traffic flowing over the internet annually will reach 667 exabytes.

Dan Gilbert to bring entrepreneurship boot camp Bizdom U to Cleveland

CLEVELAND, Ohio -- Dan Gilbert, majority owner of the Cleveland Cavaliers, will bring an entrepreneurship boot camp to downtown Cleveland next year.

CLEVELAND, Ohio -- Dan Gilbert, majority owner of the Cleveland Cavaliers, will bring an entrepreneurship boot camp to downtown Cleveland next year.

Bizdom U will train aspiring entrepreneurs and help them to create businesss plans for new technology companies in the city. Entrepreneurs will apply for a four- to six-month full-time training program, with education in marketing, sales and finance from business professionals.

Gilbert, founder of Quicken Loans Inc., launched Bizdom U in Detroit in 2007 and has provided financial support for the nonprofit operation. Of roughly 35 entrepreneurs that have completed the program in Detroit, about 15 have opened eight businesses near downtown Detroit. At least seven additional businesses should be open by early 2011, said Ross Sanders, the program's executive director.

When should you sell your company?

There’s a perception in Silicon Valley that if you sell your company for under $100 million, you’re a failure. That’s bunk, notes serial entrepreneur and venture capitalist Mark Suster in this entrepreneur thought leader lecture given at Stanford University. While an early sale is not always the right move, not every entrepreneur is going to change the world – and there’s no shame selling a small company at the right time. Suster tells the tale of how turning down what seemed like a tiny offer turned out to be a huge mistake.

Stephen Fry Gets Animated about Language

Stephen Fry Kinetic Typography - Language from Matthew Rogers on Vimeo.

.

.For a brief time in 2008, Stephen Fry, the popular British author, writer and comedian, produced a series of podcasts – called “Podgrams” – that drew on his writings, speeches and collective thoughts. (Find them on RSS and iTunes here). During one particular episode, Fry meditated on language (the English language & his own language) and a little on Barthes, Chomsky, Pinker and even Eddie Izzard. Then Matthew Rogers took that meditation and ran with it, producing a “kinetic typography animation” that artfully illustrates a six minute segment of the longer talk. Watch it above, and if you’re captivated by what Fry has to say, don’t miss his popular video, What I Wish I Had Known When I Was 18.

New Models For Clean Technology Incubation and Commercialization

We live in an age of intense global competition for more sustainable ways of providing food, water, energy and transportation to a growing population against a backdrop of diminishing and deteriorating natural resources. And thus, the race is on to create the next generation of technologies, business models and companies to provide these essential services and commodities. At stake are new, high quality jobs, export earnings, reduced dependence on imported energy, improved quality of life and host of other positive impacts. Investing in R&D would seem a no-brainer.

We live in an age of intense global competition for more sustainable ways of providing food, water, energy and transportation to a growing population against a backdrop of diminishing and deteriorating natural resources. And thus, the race is on to create the next generation of technologies, business models and companies to provide these essential services and commodities. At stake are new, high quality jobs, export earnings, reduced dependence on imported energy, improved quality of life and host of other positive impacts. Investing in R&D would seem a no-brainer.

And invest we do. According to the National Science Foundation, public and private sector R&D investment in the US was $369 billion in 2008 – over twice that of Japan (No. 2 at $148 billion) and over 3.5 times that of China (No. 3 at $102 billion).1 According to the National Business Incubator Association, the US has over 1100 business incubators as compared to roughly half that number in China. In cleantech, however, the US is losing the race to China in important areas such as solar photovoltaics and batteries where the technology traces its roots to the US and Europe.

4 key steps for website safety

Some of the most widely used sites on the Internet are attracting negative attention these days for neglecting to attend to the user experience. But for many, that’s not their biggest problem.

Some of the most widely used sites on the Internet are attracting negative attention these days for neglecting to attend to the user experience. But for many, that’s not their biggest problem.

Ten years ago, web site owners simply needed to attend to safety issues like secure servers and shopping carts. That changed with the advent of social media. Today, people are not simply interacting with the web sites; they are just as often interacting with other users through comments, sharing functions, online chat and even games.

This means that user safety and privacy have become everyone’s business. Yet too many site owners protest that they can’t protect their users from the ever growing assortment of online scams and crime.

Why two more Avatar movies will be good for tech innovation

![]() Movie maker James Cameron announced today that he will make two more Avatar movies as follow-ups to the biggest blockbuster of all time. That’s going to be a good thing for Silicon Valley because Cameron is the biggest advocate for the advancement of 3D technology and he has invented many cool 3D technologies that will be useful to the rest of the technological world.

Movie maker James Cameron announced today that he will make two more Avatar movies as follow-ups to the biggest blockbuster of all time. That’s going to be a good thing for Silicon Valley because Cameron is the biggest advocate for the advancement of 3D technology and he has invented many cool 3D technologies that will be useful to the rest of the technological world.

Cameron made the announcement on stage at the Churchill Club dinner Wednesday night in San Jose, Calif.

With the creation of Avatar, which generated $2.8 billion in worldwide box office receipts, Cameron was able to convince the world that 3D movies can be phenomenal in big movie theaters. Over the course of 12 years, he invented new 3D movie cameras that are now commonly used. Those cameras are nine-axis, servo-controlled cameras. As a rig gets close to the subject, the two cameras filming the person also move closer together so that the net result is viewable.

What seed-stage star Christine Herron’s move to Intel Capital means

Well-connected early-stage investor Christine Herron is leaving seed-stage venture-capital firm First Round Capital to join Intel Capital, the chipmaker’s corporate venture arm. The move adds another voice to the ongoing controversy over whether there is a bubble in early-stage investing that’s causing tension between angel investors and established venture capitalists.

Well-connected early-stage investor Christine Herron is leaving seed-stage venture-capital firm First Round Capital to join Intel Capital, the chipmaker’s corporate venture arm. The move adds another voice to the ongoing controversy over whether there is a bubble in early-stage investing that’s causing tension between angel investors and established venture capitalists.

Does Herron’s jump show that corporate venture-capital funds are no longer waiting on the sidelines when it comes to seed-stage funding?

Well, in Herron’s own opinion, yes—and with good reason.

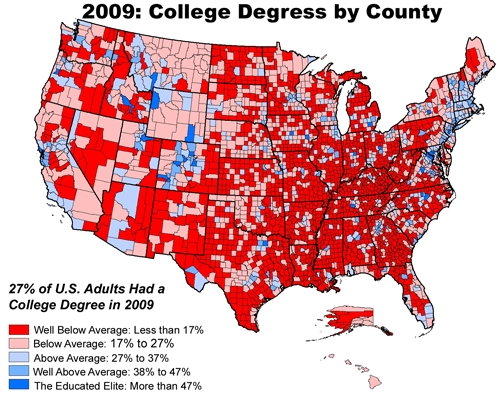

U.S. College Degrees by County

“Americans are better educated now than ever, but the distribution of people with college degrees is growing increasingly unequal,” write Roberto Gallardo and Bill Bishop in the Daily Yonder. “And the clustering of people with higher education is creating greater disparities in regional incomes and unemployment.” Their article includes three U.S. county maps showing how much above or below the national average each county has been in terms of number of adults with a college degree since 1990. Via David Brin.

National Academics Report Suggests Changes to U.S. S&T Strategy

The U.S. will need to shift from a national S&T strategy predicated on the 1950s paradigm of "control and isolation" to a global innovation environment focused on "engagement and partnerships," according to a new National Academies report. S&T Strategies of Six Countries: Implications for the United States provides an overview of national science and technology strategies in Japan, Singapore, Brazil, China, India and Russia, and concludes that the U.S. should focus on improving its balance of "top-down" and "bottom-up" innovation. The report also suggests that the U.S. should improve its global exchanges in education and R&D talent, international and national recruitment of R&D talent, and multinational corporate collaborations. Read the report ...

Seeking: Exec Dir Innovation & Commercialization RIT

RIT seeks to globally emerge and distinguish itself in the areas of innovation, creativity, commercialization and entrepreneurship. To accomplish this vision, RIT is looking for an enterprising, energetic and experienced Executive Director for Innovation and Commercialization. The Executive Director will be charged to accelerate and strengthen the university’s “Innovation Eco-system” that will be recognized and emulated globally by industry, academia and governments.

RIT seeks to globally emerge and distinguish itself in the areas of innovation, creativity, commercialization and entrepreneurship. To accomplish this vision, RIT is looking for an enterprising, energetic and experienced Executive Director for Innovation and Commercialization. The Executive Director will be charged to accelerate and strengthen the university’s “Innovation Eco-system” that will be recognized and emulated globally by industry, academia and governments.

Venture Capital and Distance

It’s possible to get financing from top tier investors if you’re located outside Silicon Valley, New York or Boston, but if you land venture or angel investments from remote investors, expect to go back to investors often for more rounds of cash. A recent study by Indiana University finance professor Xuan Tian found that entrepreneurs who raised capital from investors located more than 25 miles away were forced to raise smaller amounts, with a shorter duration between each fundraising round, than those with nearby investors.

It’s possible to get financing from top tier investors if you’re located outside Silicon Valley, New York or Boston, but if you land venture or angel investments from remote investors, expect to go back to investors often for more rounds of cash. A recent study by Indiana University finance professor Xuan Tian found that entrepreneurs who raised capital from investors located more than 25 miles away were forced to raise smaller amounts, with a shorter duration between each fundraising round, than those with nearby investors.

Comparing 28,000 venture-backed companies who raised funds between 1980 and 2006, Tian studied whether venture firms could use technology to monitor investments just as well from a distance. “We saw that visiting a company day to day made a real difference, and investors were willing to write bigger checks if they could do that,” he says. From Tian’s research, venture firms don’t necessarily abide by the so-called 20 minute rule, where venture capital firms typically want to invest in startups located within a 20 minute drive of their office, but a greater distance does make a VC hold on tighter to its purse strings. On average during this time period, firms raised 3.6 rounds of financing with 20 months in between rounds and $72.7 million in total.

The Votes Are In: 100+ VCs and Angel Investors Have Chosen the Top 50 Emerging Companies

FundingPost (http://www.FundingPost.com) proudly announced today the winning companies from its seventh annual Pitching Across America competition.

FundingPost (http://www.FundingPost.com) proudly announced today the winning companies from its seventh annual Pitching Across America competition.

FundingPost, which has been introducing entrepreneurs to investors for over 9 years, established the competition in which 100 Venture Capital Funds and Angel Investors participated as judges, voting on business summaries from emerging companies nationwide. The largest Venture Capital competition ever organized, this year's Pitching Across America (TM) was sponsored by PR Newswire, YouTern, Reitler Kailas & Rosenblatt, and Daymond John of ABC’s Shark Tank.

"We are pleased to announce the results of this year's competition! The venture capital industry is still strong, and the Investors are still looking for quality companies to invest in," said Joe Rubin, Director, FundingPost. "I'm sure that we will hear about several capital-raising success stories from this year's winners, as we have in all of the past years' Pitching Across America competitions!"

Kimberly-Clark Rolls Out Tube-Free Toilet Paper

There aren't many exciting developments in the toilet paper industry. Kimberly-Clark is trying to change that with Scott Naturals Tube-Free, a line of tube-free toilet paper set to debut Monday at Walmart and Sam's Club stores throughout the northeastern U.S. Not that exciting, you say? Consider this: Kimberly-Clark estimates that the 17 billion toilet paper tubes produced each year in the U.S. generate 160 million pounds of trash, or enough tubing to stretch over a million miles when placed end to end.

Tubeless toilet paper apparently isn't as easy to make as it sounds--in an interview with USA Today, Doug Daniels, brand manager at Kimberly-Clark, refused to explain the tubeless toilet paper's "special winding process," though he did say that it's similar to a process used on bath tissue that the company sells to businesses.

How to Pack Maximum Fun Onto a $1.2 Billion, 1,200-foot Cruise Ship

Imagine the Empire State Building, turned on its side, and floating in the ocean. That's about the size of Allure of the Seas, which, with its sister ship, Oasis of the Seas, is far-and-away the biggest passenger ship ever built. The volume of the ship is well over four times that of Titanic; it's also twice that of a modern nuclear-powered aircraft carrier.

Imagine the Empire State Building, turned on its side, and floating in the ocean. That's about the size of Allure of the Seas, which, with its sister ship, Oasis of the Seas, is far-and-away the biggest passenger ship ever built. The volume of the ship is well over four times that of Titanic; it's also twice that of a modern nuclear-powered aircraft carrier.

The Allure sets sail for the first time December 5th, from Ft. Lauderdale, and will ferry passengers on week-long excursions around the Caribbean. Recently, Co.Design sat down with Adam Goldstein, the president and CEO of Royal Caribbean, the company that built and operates Allure, to talk about how you go about building what amounts to a 24/7 theme park for 6,300 guests with 2,400 crew that also floats and moves.

$107 Sears catalog home, 1908 (assembly required)

I used to write ads for Sears, and I always admired their influence in American DIY/maker culture. They had a huge influence on reducing local general stores' price-gouging practices, and they gave consumers access to goods that were hard to come by (they started when there were no cars and only 38 US states). Back when Sears, Roebuck & Co. and Montgomery Ward were battling it out over who would be the analog version of Amazon, Sears offered increasingly ambitious and specialized catalogs. One of their most ambitious projects was mail-order homes, inspired by success of The Aladdin Company. Last year, Cory blogged about Thomas Edison's similar prefab concrete home venture. But Sears Modern Homes had huge success with their wood-framed homes from 1908 through the Great Depression. Their cheapest model was $107 in 1908 (about $2,000 today). Unlike a lot of modern prefab, these were made to last; you can still find these homes here and there around the country.