Finding the right mentor to help you steer your business towards success is a challenging, but, often necessary task for entrepreneurs. The insight, experience (and possibly seed money) that the right mentor can provide is often invaluable.

Finding the right mentor to help you steer your business towards success is a challenging, but, often necessary task for entrepreneurs. The insight, experience (and possibly seed money) that the right mentor can provide is often invaluable.

Abot 10 years ago, I was lucky enough to join forces with DC-based entrepreneur Ching-Ho Fung, after meeting him at a venture conference. I was a recent graduate of Cornell, and was, along with some friends, running a fledgling software company from my off-campus apartment. With Ching-Ho’s mentoring aid, we’ve grown that little software company into a leader with over 900 customers.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

New Advisory board of The Technopolicy Network

The Technopolicy Network brings together experts and practitioners on Science Based Regional Development. Together, they engage in an exchange of knowledge and experience that helps policy makers, technology transfer officers, facilitators and researchers alike. The international contacts promote a broader understanding of the issues involved and provide opportunities for cooperation.

The Technopolicy Network brings together experts and practitioners on Science Based Regional Development. Together, they engage in an exchange of knowledge and experience that helps policy makers, technology transfer officers, facilitators and researchers alike. The international contacts promote a broader understanding of the issues involved and provide opportunities for cooperation.

The governance and management of the Network is accomplished by a Secretariat and an Advisory Board. The Advisory Board serves as the eyes and ears of the network in a community of practice. The Technopolicy Network is honored to present three new advisory board members:

For a full overview of our advisory board, please check our website

Six-year-old thrashing on a plank

Asher Bradshaw is a six-year old skateboard wizard: watch him thrash like a fiend at the Venice Beach skate-park and marvel.

Why don't jellyfish sting each other?

Along with this lovely jellyfish photo that she posted to the BoingBoing Flickr Pool, Kate Tomlinson asks, "How come they don't sting each other?"

Along with this lovely jellyfish photo that she posted to the BoingBoing Flickr Pool, Kate Tomlinson asks, "How come they don't sting each other?"

Not a bad question. How does a creature with no brain—but with long, venomous tentacles—manage to travel in dense packs without things getting really socially awkward? I took Kate's query to Southern Fried Scientist, a science blogger who doubles as a graduate student studying deep-sea biology.

Jellyfish can and do sting other jellyfish, he says, but really only when they're hunting jellies of another species. They don't sting the other members of their same-species swarm. Neither (luckily) do they zap themselves. It works because jellyfish tentacles aren't inherently poisonous. Rather, it's the nematocytes—special cells that line the tentacles. When touched, nematocytes fire off microscopic quills that lodge in a victim and pump in the venom. But this weapon comes with a built-in safety switch.

Words: amazing video poem

WORDS from Everynone on Vimeo.

Production company Everynone created a terrific video poem linking words and images together in a lovely flow. Directed by Daniel Mercadante and Will Hoffman, it's a collaboration with Radio Lab and NPR. Also, watch their remix of it, using YouTube clips, at the Everynone site. (Thanks, Gabe Adiv!)

Big Fish Help Out the Smaller Fish in the Life Sciences Pond

In spite of the abundance of PhDs, MDs, JDs, and MBAs in biotech and pharma, we all know that on-the-job learning is really how this industry is built. Nobody goes to university to learn how to be a great CEO or manager, and there aren’t any courses in grad school where budding researchers can learn the way a pharmaceutical company operates.

In spite of the abundance of PhDs, MDs, JDs, and MBAs in biotech and pharma, we all know that on-the-job learning is really how this industry is built. Nobody goes to university to learn how to be a great CEO or manager, and there aren’t any courses in grad school where budding researchers can learn the way a pharmaceutical company operates.

That’s why it’s good to hear about the industry experience program started by the MassGeneral Postdoc Association (MGPA) with help from MGH and the MassBio Ed Foundation. It’s a grown-up version of the “take your child to work day” in which postdocs at MGH-affiliated laboratories—there’s about 1,100—have a chance to see what it’s like to work in a biotechnology or pharmaceutical company. They meet executives and scientists, tour offices and the labs, and get to ask questions about lifestyle, freedom to publish, and the various career tracks one can follow at a company. “Industry is this huge black box that academic trainees haven’t been able to see into,” says Adnan Abu-Yousif, a postdoctoral fellow at MGH who founded the program.

The Future of Personal Robotics: Open Source

This week marks the third anniversary of ROS (Robot Operating System), an open-source software platform for the robotics industry developed by Stanford and Silicon Valley robotics research lab Willow Garage. In that short time, ROS has skyrocketed in popularity. Robot hardware manufacturers, commercial research labs, and software companies are all adopting the platform. And ROS is just getting started.

This week marks the third anniversary of ROS (Robot Operating System), an open-source software platform for the robotics industry developed by Stanford and Silicon Valley robotics research lab Willow Garage. In that short time, ROS has skyrocketed in popularity. Robot hardware manufacturers, commercial research labs, and software companies are all adopting the platform. And ROS is just getting started.

"We set out at the beginning with a commitment to open source," says Steve Cousens, President and CEO of Willow Garage. "In order to get an industry going in personal robotics, it's going to take the ability for a lot of people to experiment. An open platform makes it easy for people to tinker and innovate."

Is IP Standing in the Way of a Green Planet?

The potential of intellectual property rights to impede the cleantech revolution has sparked a lively debate full of heated rhetoric. Secretary of Energy Steven Chu jump-started this discussion last year during a discussion of the Obama administration's goals to promote development of green technologies.

The potential of intellectual property rights to impede the cleantech revolution has sparked a lively debate full of heated rhetoric. Secretary of Energy Steven Chu jump-started this discussion last year during a discussion of the Obama administration's goals to promote development of green technologies.

Addressing the importance of international collaboration, Secretary Chu said “we should work very hard in a very collaborative way - by very collaborative I mean share all intellectual property as much as possible.” This suggestion, extreme on its face, reminds us that IP rights play an important role in the climate change debate and must be meaningfully addressed at a global level.

The Age of the Entrepreneur

I have been reading about the changing landscape of how technology companies get their initial outside funding after friends and family have chipped in. Seed or early stage investing, as it is referred to by entrepreneurs, angels, VCs and their investors (limited partners) is a critical part of the technology innovation and funding ecosystem because it has historically been the only consistent source of returns for the industry. This is where angels and VCs make their money and why so much has been written about the subject over the past 6 months.Paul Kedrosky started the discussion with "The Coming Super-Seed Crash" in which he argued that a crash was inevitable as a result of too many companies getting funded by too many angels and third string VCs at skyrocketing valuations.

I have been reading about the changing landscape of how technology companies get their initial outside funding after friends and family have chipped in. Seed or early stage investing, as it is referred to by entrepreneurs, angels, VCs and their investors (limited partners) is a critical part of the technology innovation and funding ecosystem because it has historically been the only consistent source of returns for the industry. This is where angels and VCs make their money and why so much has been written about the subject over the past 6 months.Paul Kedrosky started the discussion with "The Coming Super-Seed Crash" in which he argued that a crash was inevitable as a result of too many companies getting funded by too many angels and third string VCs at skyrocketing valuations.

N.S. eyes venture capital fund

The provincial government wants to set up a venture capital fund for green technology and science entrepreneurs in the region.

The provincial government wants to set up a venture capital fund for green technology and science entrepreneurs in the region.

Nova Scotia is looking to form a privately operated venture capital fund targeting clean technology companies in Atlantic Canada, Premier Darrell Dexter announced at the Power of Green Conference in Halifax on Monday.

The province is willing to start the fund with part of its $30-million investment in the Nova Scotia First Fund made last year.

The venture capital fund will invest in knowledge-based companies that have potential to grow but do not have the cash flow to secure financing from traditional lenders, Dexter told about 240 delegates at the conference.

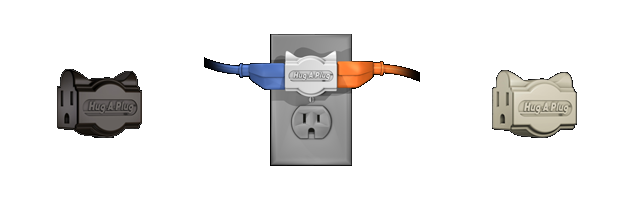

A Safer Outlet Plug-in Adapter

Plug-in adapters are everywhere. They duplicate the number of plug-ins available to each one and they can also increase the risk of fire within a home reports The Record Searchlight.

The Hug-A-Plug, a new dual-plug grounded electrical outlet adapter that lets plugs lie almost flush with the wall, was introduced in March. You may think you’ve seen or heard of this type of plug before, but you haven’t.

“It’s so simple, people are sure they’ve seen this plug before,” said Hug-A-Plug inventor Bob Green.

“If you compare it to any adapter out there,” Green said, “(this one is) more versatile — you can do more things with it.”

Splitting Startup Equity for Your Piece of the Pie

One of the first tough decisions that startup founders have to make is how to allocate or split the equity among co-founders. The easy answer of splitting it equally among all co-founders, since there is minimal value at that point, is usually the worst possible answer, and often results in a later startup failure due to an obvious inequity.

One of the first tough decisions that startup founders have to make is how to allocate or split the equity among co-founders. The easy answer of splitting it equally among all co-founders, since there is minimal value at that point, is usually the worst possible answer, and often results in a later startup failure due to an obvious inequity.

Another common “failure to start” situation I see is one where the “idea person” insists that the idea is 90% of the value (and 90% of the equity). In the real world, the "idea" is a very small part of the overall equation. A startup is all about "execution" - meaning the equity should be allocated based on the value that each partner brings to the table in each of these dominant variables:

1. Experience running a startup business. Running a new business starts with building a solid and credible business plan, working the investor funding process, and building an organization from nothing, with minimal resources. Successful Fortune 500 executives need not apply, since most would have experience with any of these tasks.

The One Question All Innovators Need to Ask

Innovators always want their offspring to be faster, better, and/or cheaper. Successful innovators constantly push novelty to create new value. But the innovators who reap the most rewarding results understand the importance of asking:

Innovators always want their offspring to be faster, better, and/or cheaper. Successful innovators constantly push novelty to create new value. But the innovators who reap the most rewarding results understand the importance of asking:

What does this innovation want you to become?

Facebook wants you to become someone who attracts, wins, and manages a social network of friends and acquaintances while becoming more sharing and open about your own life. Google wants you to become someone always willing to take a few moments to tap a few keys to explore any question you might have around any topic you might be interested in. The iPad wants you to become someone who's willing to touch and stroke your way to digital entertainment and information anywhere and anytime. The Kindle wants you to become a bookworm extraordinaire; a textually-tropic annelid who loves to read, annotate and share books and magazines.

Mining the Seafloor for Rare-Earth Minerals

For decades, entrepreneurs have tried to strike it rich by gathering up ugly potato-size rocks that carpet the global seabed. Known as manganese nodules, the rocks are plentiful in nickel, copper and cobalt, as well as manganese and other elements, but lie miles down in inky darkness. Building giant machines to vacuum them up, despite much study and investment, has never proved to be economic.

For decades, entrepreneurs have tried to strike it rich by gathering up ugly potato-size rocks that carpet the global seabed. Known as manganese nodules, the rocks are plentiful in nickel, copper and cobalt, as well as manganese and other elements, but lie miles down in inky darkness. Building giant machines to vacuum them up, despite much study and investment, has never proved to be economic.

Now, the frustrated visionaries are talking excitedly about the possibility of belated success, and perhaps even profits.

The nodules turn out to contain so-called rare-earth minerals — elements that have wide commercial and military application but have hit a production roadblock. China, which controls some 95 percent of the world’s supply, had blocked shipments, sounding political alarms around the globe and a rush for alternatives. China ended its embargo late last month, but the hunt for other options continues.

Voices: What's Next in Science

Asteroids first formed at the birth of the solar system 4.6 billion years ago, developing into small proto-planets. The biggest asteroids, like the 330-mile-wide Vesta, might have even grown into full-blown planets if not for the pull of Jupiter’s powerful gravitational field. Since then, collisions have blasted asteroids apart into smaller bodies. Astronomers want to know just how planetlike asteroids like Vesta became. It’s possible, for example, that Vesta developed a heavy core and might even have a magnetic field. Once the Dawn takes a close look at Vesta, it will move on to another giant asteroid, Ceres, which has water-bearing minerals and perhaps even a weak atmosphere. By comparing the two asteroids, astronomers hope to learn about early planet formation.

Asteroids first formed at the birth of the solar system 4.6 billion years ago, developing into small proto-planets. The biggest asteroids, like the 330-mile-wide Vesta, might have even grown into full-blown planets if not for the pull of Jupiter’s powerful gravitational field. Since then, collisions have blasted asteroids apart into smaller bodies. Astronomers want to know just how planetlike asteroids like Vesta became. It’s possible, for example, that Vesta developed a heavy core and might even have a magnetic field. Once the Dawn takes a close look at Vesta, it will move on to another giant asteroid, Ceres, which has water-bearing minerals and perhaps even a weak atmosphere. By comparing the two asteroids, astronomers hope to learn about early planet formation.

Twilight of the Blood Draws?

Researchers who study how drugs like morphine affect infants are bedeviled by the fact that newborns' tiny bodies can't readily spare much blood for testing. As a result, pharmacology in babies often involves guesswork. That could soon change.

Researchers who study how drugs like morphine affect infants are bedeviled by the fact that newborns' tiny bodies can't readily spare much blood for testing. As a result, pharmacology in babies often involves guesswork. That could soon change.

A new method of screening miniscule amounts of dried blood for chemicals could allow researchers to get all the information they need from small amounts of blood. The researchers' first goal is to produce a drug-dosing guide for infants. But the list of potential applications is far longer, says Jeffrey Galinkin, an anesthesiologist at the University of Colorado who heads the effort. Infection specialists could use the technique to diagnose HIV or tuberculosis, for instance, while sports officials could use it to monitor athletes for banned substances, he says.

Special meeting may break deadlock over EU patents

The Belgian Presidency has proposed a new compromise text – seen by EurActiv - to break a long-standing deadlock over EU patents which could lead to an historic deal at an extraordinary Competitiveness Council next Wednesday (10 November).

The Belgian Presidency has proposed a new compromise text – seen by EurActiv - to break a long-standing deadlock over EU patents which could lead to an historic deal at an extraordinary Competitiveness Council next Wednesday (10 November).

The new proposal, which has been circulating among EU diplomats since 3 November, contains important steps forward compared to the previous compromise text tabled in October, which proved ineffective.

This triggered the convening of a special Competitiveness Council next Wednesday, which follows an official and an informal Council that have already been held during the Belgian Presidency and precedes another two meetings scheduled for November and December. On average only two Competitiveness Councils are held per semester.

Is your laptop cooking your testicles?

Turns out, unsurprisingly, that sitting with a computer on your lap will crank up the temperature of your nether regions, which could affect sperm quality.

And there is little you can do about it, according to the authors of a study out today in the journal Fertility and Sterility, short of putting your laptop on a desk.

The researchers hooked thermometers to the scrotums of 29 young men who were balancing a laptop on their knees. They found that even with a lap pad under the computer, the men's scrotums overheated quickly.

The 59 Commandments of Business Networking

Business networking is one of the most effective marketing and prospecting tools you can use to grow your business. Of course, done incorrectly it can actually be harmful to your business.

Business networking is one of the most effective marketing and prospecting tools you can use to grow your business. Of course, done incorrectly it can actually be harmful to your business.

Somewhere down the road salespeople were given the idea that business networking meant pitching and selling. Eek! Nothing could be further from the truth.

Entrepreneurship in the Fast Lane

What do all of the most dynamic 21st Century entrepreneurial companies have in common? They:

What do all of the most dynamic 21st Century entrepreneurial companies have in common? They:

1. Pursue Global Markets

2. Place Corporate Culture Above All Else

3. Embrace the Black Swan Both Within and Without

1. Pursue Global Markets. If you don’t have a business that can scale globally, then either don’t bother or just content yourself with staying small.

Try these statistics on for size, from 1999 to today Asia’s share of the world’s Initial Public Offerings grew from 12% to 66%.

In that same time frame, United States IPO volume declined 75% in real terms and now accounts for less than 11% of the global total. 7 Companies in China have raised more than $1 billion in an IPO this year. In the U.S. so far, no company has raised more than $700 million and it is somewhat of a sad commentary that the biggest U.S. IPO by far this year will be the government ward General Motors.