As the first high-tech entrepreneur to lead a top research university, John Hennessy has re-rooted Stanford in Silicon Valley -- while extending its global reach.

In a roller-coaster decade, the popular leader has presided over more than $6.3 billion in gifts and dozens of new construction projects that place the university in the red-hot center of innovation, from stem cells and neurosciences to energy and the environment. For four years in a row, Stanford has raised more money than any university in the country.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

Open Innovation

The most interesting presentation at last week’s ACCTCanada Directors Forum was, in my opinion, on open innovation by Angus Livingstone,

UILO at UBC. Much of the discussion by other presenters focused on

patents and other control mechanisms, while Angus showed the shifting

paradigms that we are experiencing in university knowledge transfer. He

explained that the main shift over the next five years will be from closed to open innovation, in parallel with shifts from outputs to impacts and from transactions to relationships. Angus highlighted the old paradigm:

The most interesting presentation at last week’s ACCTCanada Directors Forum was, in my opinion, on open innovation by Angus Livingstone,

UILO at UBC. Much of the discussion by other presenters focused on

patents and other control mechanisms, while Angus showed the shifting

paradigms that we are experiencing in university knowledge transfer. He

explained that the main shift over the next five years will be from closed to open innovation, in parallel with shifts from outputs to impacts and from transactions to relationships. Angus highlighted the old paradigm:

- Patents

- Licenses

- Spin-offs

- Proprietary industry research funding

The Entrepreneurial University

What is an entrepreneurial university, and how does it address the world’s biggest problems?

What is an entrepreneurial university, and how does it address the world’s biggest problems?

It’s a question that we’ve been asked regularly the last few months in the run-up to the recent publication of our book, Engines of Innovation: The Entrepreneurial University in the 21st Century (University of North Carolina Press). We wrote the book because we think this is an important question. Friends of higher education who believe, as we do, that universities are the key to taking the U.S. economy to a prosperous and more egalitarian future need examples and evidence to help make the case for investment in universities and basic research.

Want To Be A VC? Round Out Your Resume

Continuing my thread on getting the VC job.

Continuing my thread on getting the VC job.

When preparing to get a venture job, it’s important to understand which role you’re likely to fill and what experience you need to do so.

You need to make an honest assessment of the various types of experience that you do an do not have that are attractive to VCs, filling gaps where you can to fit into one of the 4 VC molds. If you have some investing experience, for example, you may want to check the operating experience box by working at a startup, taking a role at a large corporation or starting a company. If you’re obtaining a graduate level degree, you can partially check this box by interning or advising startups in your spare time.

The segmentation of the venture industry

Ford Motors dominated the auto market in the early 20th century with a

single car model, the Model T. At the time, customers were seeking

low-cost, functional cars, and were satisfied by an extremely

standardized product (Ford famously quipped that “customers can choose

it in any color, as long as it’s black”). But as technology improved and

serious competitors emerged, customers began wanting cars that were

tailored to their specific needs and desires. The basis of competition

shifted from price and basic functionality to ”style, power, and prestige“.

General Motors surpassed Ford by capitalizing on this desire for

segmentation. They created Cadillacs for wealthy older folks, Pontiacs

for hipsters, and so on.

Ford Motors dominated the auto market in the early 20th century with a

single car model, the Model T. At the time, customers were seeking

low-cost, functional cars, and were satisfied by an extremely

standardized product (Ford famously quipped that “customers can choose

it in any color, as long as it’s black”). But as technology improved and

serious competitors emerged, customers began wanting cars that were

tailored to their specific needs and desires. The basis of competition

shifted from price and basic functionality to ”style, power, and prestige“.

General Motors surpassed Ford by capitalizing on this desire for

segmentation. They created Cadillacs for wealthy older folks, Pontiacs

for hipsters, and so on.

Today, the venture financing industry is going through a similar segmentation process. Venture capital has only existed in its modern form for about 35 years. In the early days there were relatively few VCs. Entrepreneurs were happy simply getting money and general business guidance. Today, there is a surplus of venture capital and entrepreneurs have become increasingly savvy “shoppers.” As a result, competition amongst venture financiers has increased and their “customers” (entrepreneurs) have flocked to more specialized “products.”

René Vézina : L’innovation, le passage obligé vers la prospérité

Chronique, samedi 25 septembre 2010, p. 8

Chronique, samedi 25 septembre 2010, p. 8

Saint-Roch, un quartier de la ville de Québec, jadis moribond, reprend vie au point de devenir un des endroits les plus branchés de la province.

L'industrie éolienne peut maintenant compter sur un allié : le Cégep de Matane, qui répond à ses besoins avec son programme de technologie de l'électronique industrielle.

Montréal compte maintenant 6 000 jeunes employés dans l'industrie du jeu vidéo, un secteur quasi inexistant il y a 15 ans.

Top 10 Pop-Culture Gangsters

Steve Buscemi portrays a powerful politico and gangster named Nucky Thompson in HBO's new series Boardwalk Empire. To mark the show's premiere, TIME takes a look at other Mob bosses who have reigned on American television and movie screens

The Huge Value Sequoia Capital And Other Venture Capitalists Help Create

Last week I sat down with Sequoia Capital partner Roelof Botha to prepare for tomorrow’s Super Angels To Super VCs — The Changing Face Of Venture Capital panel at TechCrunch Disrupt.

Last week I sat down with Sequoia Capital partner Roelof Botha to prepare for tomorrow’s Super Angels To Super VCs — The Changing Face Of Venture Capital panel at TechCrunch Disrupt.

As part of that conversation I asked about some of the big exits that Sequoia-backed startups have enjoyed over the last couple of years. After naming a few I became more curious and asked for more data.

Dave McClure’s First Investment In China: ChinaNetCloud (TCTV)

As we wrap up our GeeksOnaPlane video series for TechCrunch TV, I

thought I’d offer a perspective on Asia from the eyes of a Silicon

Valley geek and investor (not to mention the father of two

Japanese-American kids).

As we wrap up our GeeksOnaPlane video series for TechCrunch TV, I

thought I’d offer a perspective on Asia from the eyes of a Silicon

Valley geek and investor (not to mention the father of two

Japanese-American kids).

For those aren’t familiar with what GeeksOnaPlane (aka “GoaP”) is all about, we bring geeks and investors from Silicon Valley and elsewhere to geeky locations all around the globe. We talk/ meet/ socialize to understand more about technology, entrepreneurship, and new markets through travel and cultural exchange. To learn more, visit our website and blog and meet the 100+ folks who have traveled with us to Asia in 2009 and 2010, and Europe in 2009, or see any of the thousands of photos, tweets, and other social media created while we visited 10+ countries in the last 2 years.

14 Ways to Spark Innovation

There’s a lot of talk these days about the importance of innovation. All CEOs worth their low salt lunch want it. And they want it, of course, now.

There’s a lot of talk these days about the importance of innovation. All CEOs worth their low salt lunch want it. And they want it, of course, now.

Innovation, they reason, is the competitive edge.

What sparks innovation? People. What sparks people? Inspired ideas that meet a need — whether expressed or unexpressed — ideas with enough mojo to rally sustained support.

Is there anything a person can do — beyond caffeine, corporate pep talks, or astrology readings — to quicken the appearance of breakthrough ideas?

Why Boston Fails Young Entrepreneurs

If I hear one more person ask me ‘How do we keep young entrepreneurs here in Boston?’ I will run headfirst into a wall. Not because it’s a bad question but because in my experience the people asking the question are blowing so much hot air that I can’t take them seriously anymore. My head might actually feel better after plowing through a sheet of drywall.

If I hear one more person ask me ‘How do we keep young entrepreneurs here in Boston?’ I will run headfirst into a wall. Not because it’s a bad question but because in my experience the people asking the question are blowing so much hot air that I can’t take them seriously anymore. My head might actually feel better after plowing through a sheet of drywall.

Now let’s deconstruct why I believe Boston fails the young entrepreneur and how you can help.

1. How to build a business

In Boston, we spend way too much time focusing on how to raise capital and nearly zero time on how to build a business. Ask yourself the last time you saw an event on how to sell a product or how to acquire users. The lean startup events have been a great start, but there is a serious need for more.

And Tomorrow's Winners Will Be...

I t's one thing to know what innovations are winning awards today, but what if you could know what will win in, say, five or 10 years?

t's one thing to know what innovations are winning awards today, but what if you could know what will win in, say, five or 10 years?

We don't have a crystal ball, but we have the next best thing: the informed opinions of people who are either innovators themselves or who study innovation in various fields.

Here are some of their thoughts on which areas—and possible companies—will see the most innovation in the years ahead:

Financing Your Start-Up Business - Debunking the Myth of “Free” Grants

By Fred Patterson

By Fred Patterson

It’s the Urban Myth that won’t stay debunked. The Government will give you “free” money to start your business. It’s easy to get! All you have to do is ask them for it! Don’t know where to apply? Buy my book and find out! Only $69.95!

Uh-huh. Sure. That “Free Lunch” you’re looking for? Guess what? It’ll cost you $69.95 (plus shipping and handling)! There is no free lunch, folks. NO ONE is going to give you money without expecting something in return. It’s called the “WIIFM” factor. What’s In It For Me? There’s always a WIIFM. And all WIIFMs come with strings attached.

But there are different kinds of strings. And, guess what? If you can satisfy the WIIFM and are willing to manage the expectations of the string holders, money is available. It’s just never free, and never without those strings.

For perspective, let’s classify the different ways a business can be financed, after the owner has exhausted all personal funds, and bootstrapping (using generated revenues to finance all costs) is premature or insufficient:

| Type of Financing | From Whom | WIIFM | Expectations |

| Amateur | The 3Fs: Family, Friends and Fools | To support you personally | Don’t squander the money and embarrass them |

| Grant | Government Agency or Foundation | Support their Mission by helping solve a problem | Perform and report your best efforts |

| Debt | Banks (may be SBA guaranteed) | The Interest you pay them | Keep current on debt servicing or forfeit your collateral |

| Equity | Angels or Venture Capital Investors | Build wealth via a significant return on their investment (ROI) | Take their advice whenever offered and provide that ROI |

Why Should an Entrepreneur Brand Themself?

As I write articles on how an

entrepreneur should brand themself, I’ve been receiving questions on WHY

an entrepreneur should focus on personal branding. Here are some of the

reasons why every entrepreneur should focus on personal branding:

As I write articles on how an

entrepreneur should brand themself, I’ve been receiving questions on WHY

an entrepreneur should focus on personal branding. Here are some of the

reasons why every entrepreneur should focus on personal branding:

Why brand yourself?

You are the face of your brand/company

As an entrepreneur, you are the main representative of your

business. Being that you are the one with the most at stake to the

success of the company, you have the most desire and passion to see it

succeed. If you are working on your personal brand, you are in essence

working on your business as well.

DuPont’s Yet2 Raises $100 Million After Japan Tie-Up

Yet2.com, a U.S. patent distributor

headed by Benjamin duPont, raised $100 million for a fund to

invest in startup companies and is using some of the financing

to tie up with venture capital firm Japan Asia Investment Co.

Yet2.com, a U.S. patent distributor

headed by Benjamin duPont, raised $100 million for a fund to

invest in startup companies and is using some of the financing

to tie up with venture capital firm Japan Asia Investment Co.

Under the agreement, yet2.com will help the Japanese firm, also known as JAIC, raise funds and will share returns on investments made through the new fund, said duPont, a direct descendant of the founder of U.S. chemical maker, DuPont Co. Tokyo-based JAIC will help the U.S. firm find potential investments, he said.

Yet2.com raised funds from wealthy individuals including the duPont family and aims to mainly invest in U.S.-based electronics, medical device and environmental technology developers. JAIC is seeking new funding from high-net worth individuals and families after the worst financial crisis since the 1930s sapped demand from institutional investors, said Kazuhiro Umeda, a Tokyo-based senior manager at the firm.

The Worst Ads of 2010

It seems advertisers are hell-bent on making the commercial breaks that separate fans from Mad Men and Jersey Shore

the longest, most excruciating minutes of our lives. In the last year,

we've suffered through Progressive's painful spokeswoman Flo squawking

about insurance and awkward State Farm ads that remind us in depressing

terms just how bankrupt we all are from the recession ("Our real

national past-time? Saving money!").

It seems advertisers are hell-bent on making the commercial breaks that separate fans from Mad Men and Jersey Shore

the longest, most excruciating minutes of our lives. In the last year,

we've suffered through Progressive's painful spokeswoman Flo squawking

about insurance and awkward State Farm ads that remind us in depressing

terms just how bankrupt we all are from the recession ("Our real

national past-time? Saving money!").

Thankfully, The Consumerist has been keeping track. Out today are their nominations for the Worst Ads of 2010, a list of some of the most mind-blowingly stupid commercials plaguing America's airwaves. We've pulled a collection of some of the worst--head here to vote for your favorites, er, least favorites rather.

Dick Tracy: The Original Film Series Online

Chester Gould first introduced Dick Tracy,

the legendary police detective, to the American public in 1931, back

when he launched his syndicated comic strip – a strip that he would

continue writing until 1977. The character resonated immediately, and

soon enough, Dick Tracy took to the airwaves (listen to radio episodes here)

and then eventually the silver screen. In 1937, Republic Pictures

released a Dick Tracy film series comprised of 15 episodes/chapters,

each running about 22 minutes on average. And, thanks to Film Annex, you

can now revisit them (for free) online at DickTracyTV.com.

Above we have featured a video that gives you the entire series in one

handy clip. It runs roughly 4 and a half hours (got an afternoon to

spare?), and, please note, the large file takes some time to load. You can also watch, or even download, this file at The Internet Archive.

Chester Gould first introduced Dick Tracy,

the legendary police detective, to the American public in 1931, back

when he launched his syndicated comic strip – a strip that he would

continue writing until 1977. The character resonated immediately, and

soon enough, Dick Tracy took to the airwaves (listen to radio episodes here)

and then eventually the silver screen. In 1937, Republic Pictures

released a Dick Tracy film series comprised of 15 episodes/chapters,

each running about 22 minutes on average. And, thanks to Film Annex, you

can now revisit them (for free) online at DickTracyTV.com.

Above we have featured a video that gives you the entire series in one

handy clip. It runs roughly 4 and a half hours (got an afternoon to

spare?), and, please note, the large file takes some time to load. You can also watch, or even download, this file at The Internet Archive.

How to determine if your idea is worth the effort

Ideas are cheap.

As entrepreneurs, we’ve got a constant flow of ‘em. They’re new. They’re innovative. And any one of them might be the next “big” thing.

We love to brainstorm. It’s in our DNA. But simply having ideas doesn’t make us entrepreneurs. In fact, ideas without action are usually called “dreams”.

Deciding which ideas to pull from the pile and dedicate resources toward is tough. As Eric Ries’ Lean Startup movement has spread, “ferocious customer-centric rapid iteration” has become the mantra of the majority of this year’s web startups. But, how do you start testing and validating an idea? Do you have to build a minimum viable product (MVP) or prototype? What’s the cost of creating and testing an MVP for your idea?

Why IBM Could Be Bigger Than Facebook in Social Media

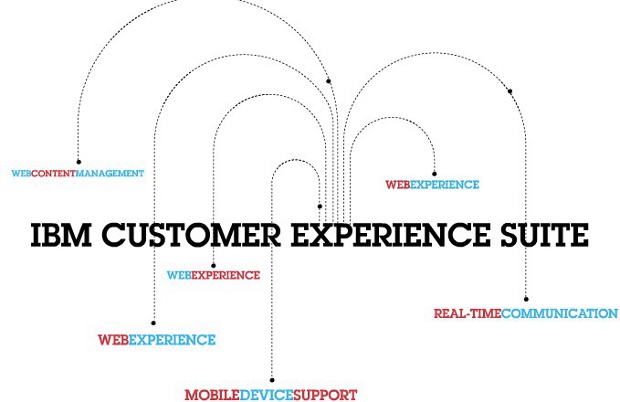

Last week IBM announced a new software portfolio that is the clearest indication yet that social media has truly changed the business landscape.

Last week IBM announced a new software portfolio that is the clearest indication yet that social media has truly changed the business landscape.

Fathoming a new product from IBM via a launch event is like trying to

understand the ocean by watching a wave. Nonetheless that was my task,

swimming through the presentations and ultimately landing an interview

with Jeffrey Schick, IBM's VP of Social Software. Drenched in the

vision Schick shared for the IBM Customer Experience Suite, it occurred

to me that IBM could end up being more important to the business use and

monetization of social media than Facebook.

Sad news out of England

Sad news out of England