After months of speculation, it’s finally official: the Chinese economy, as measured by GDP, is larger than the Japanese economy.

In the second quarter of 2010, the Japanese economy was valued at about

$1.29 trillion, the Chinese economy at $1.34 trillion. The gap will

widen next year and for the foreseeable future.

After months of speculation, it’s finally official: the Chinese economy, as measured by GDP, is larger than the Japanese economy.

In the second quarter of 2010, the Japanese economy was valued at about

$1.29 trillion, the Chinese economy at $1.34 trillion. The gap will

widen next year and for the foreseeable future.

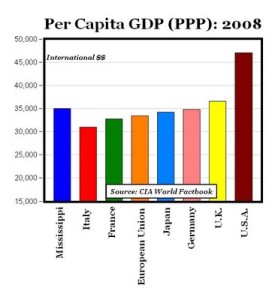

The swap of the number two and three spots in the world, behind the U.S., is heralded as (i) a sign of Chinese ascendance and Japanese stagnation; and (ii) proof of the superiority of the PRC’s state-led development model. This swap is certainly not the result of a superior development model and it might not even say too much about Chinese ascendance. This is because, while GDP does measure size, it is a flawed measure of economic performance and prosperity.

At a

At a  Felicis Ventures

Felicis Ventures

The

The  Greentech Media catalogs the ghosts of greentech IPOs past, looks at firms ready to float, and predicts a few likely candidates for the public markets.

Greentech Media catalogs the ghosts of greentech IPOs past, looks at firms ready to float, and predicts a few likely candidates for the public markets. Eight percent ain't great, but it's better than nothing.

Eight percent ain't great, but it's better than nothing.  Following up on chatter following my blog last week discussing the

need for caution around the quality of interventions that seek to

provide technical support to entrepreneurs, I will continue the

conversation thread this week with a post discussing another innovative

entrepreneurial support program - iStart, which happens to open for

business today.

Following up on chatter following my blog last week discussing the

need for caution around the quality of interventions that seek to

provide technical support to entrepreneurs, I will continue the

conversation thread this week with a post discussing another innovative

entrepreneurial support program - iStart, which happens to open for

business today.

Anyone who knows cornhole knows Peter O’Neill.

Anyone who knows cornhole knows Peter O’Neill.

Poor European entrepreneurs. They can only dreams of

Poor European entrepreneurs. They can only dreams of

Stanford University's Entrepreneurship Corner provides a free collection of over 1600 videos and podcasts, featuring lectures by today's Entrepreneurial Thought Leaders.

Stanford University's Entrepreneurship Corner provides a free collection of over 1600 videos and podcasts, featuring lectures by today's Entrepreneurial Thought Leaders.  This is a photo of the Atlantis AK1000, a 130 ton, 74-foot-tall tidal

turbine that will be installed underwater off the cost of Scotland. It

is designed to supply electrical power for 1,000 households.

This is a photo of the Atlantis AK1000, a 130 ton, 74-foot-tall tidal

turbine that will be installed underwater off the cost of Scotland. It

is designed to supply electrical power for 1,000 households.

I have conducted an ongoing email and blog exchange for several years with the Founder and CEO of an entrepreneurial client firm, a fast-growth, B2B cloud-identity-security software provider: Ping Identity. He comes up with penetrating questions and observations, and I respond. Maybe others can benefit by following

I have conducted an ongoing email and blog exchange for several years with the Founder and CEO of an entrepreneurial client firm, a fast-growth, B2B cloud-identity-security software provider: Ping Identity. He comes up with penetrating questions and observations, and I respond. Maybe others can benefit by following