Question: I liked your article on VentureBeat a couple of weeks ago about what to watch-out for as a buyer of a business. What about if I’m a seller? I’m the founder of a web-based music business, and I’m ready to sell and move onto my next venture. Any advice would be appreciated.

Question: I liked your article on VentureBeat a couple of weeks ago about what to watch-out for as a buyer of a business. What about if I’m a seller? I’m the founder of a web-based music business, and I’m ready to sell and move onto my next venture. Any advice would be appreciated.

Answer: Thanks! Here are five quick tips in connection with selling a venture:

Be Careful with Private Equity Buyers. Private equity firms are in the business of buying and selling companies. Accordingly, they are extremely sophisticated and savvy and are often represented by large, aggressive law firms. Deals with private equity buyers are generally more complex than those done with strategic buyers due to, among other things, the level(s) of debt added to the target and/or financial engineering.

Moreover, unlike most strategic buyers, private equity buyers usually require the selling entrepreneur to rollover part of his/her equity into the acquirer (or, in other words, to maintain skin in the game) and may include a financing condition in the acquisition agreement – which in today’s choppy debt markets adds a level of uncertainty to closure.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

Competition Fierce for New York's First Clean-Tech Executive Education Program

140 Apply for 25 Openings in Unique Initiative

by NYU-Poly and NYSERDA to Nurture Leaders for New York’s Clean-Tech

Future

140 Apply for 25 Openings in Unique Initiative

by NYU-Poly and NYSERDA to Nurture Leaders for New York’s Clean-Tech

Future

NEW YORK,

April 5, 2010 – An elite and diverse group of 25 New York business

leaders — each with more than 20 years of experience — is going back to

school to learn the tools of the new clean-tech economy. Selected from a

highly competitive pool of 140 applicants, these executives are

participating in the inaugural program – a rigorous academic initiative

aimed at turning them into clean-technology business leaders and

entrepreneurs.

NEW YORK,

April 5, 2010 – An elite and diverse group of 25 New York business

leaders — each with more than 20 years of experience — is going back to

school to learn the tools of the new clean-tech economy. Selected from a

highly competitive pool of 140 applicants, these executives are

participating in the inaugural program – a rigorous academic initiative

aimed at turning them into clean-technology business leaders and

entrepreneurs.

CleantechExecs is a unique executive education program created by the Polytechnic Institute of New York University (NYU-Poly) with the New York State Research and Development Authority (NYSERDA). It prepares top talent to help build a clean-tech business cluster in New York City.

“The response to our call for applicants was remarkable, in large part because the business community recognizes that clean technology will soon touch every business in America, not just those dedicated to producing ‘green’ goods and services,” said Dr. Mel Horwitch, professor at NYU-Poly’s Department of Technology Management. Horwitch, who headed the curriculum design, said that enrollees seek to prepare themselves for issues ranging from energy efficiency to project development, analytics and financing.

Entrepreneurship in Turkey

Turkey offers quite a sophisticated platform for entrepreneurs. It has a diversified industrial base, a relatively stable political and economic environment, a critical mass of willing early adopters, a considerable talent pool, a strong domestic market and underserved neighboring markets. Yet, currently only 6 out of 100 people are entrepreneurs – a very low rate given the country’s level of development. What challenges does Turkey need to address in order to unleash entrepreneurship as a force for economic growth?

Turkey offers quite a sophisticated platform for entrepreneurs. It has a diversified industrial base, a relatively stable political and economic environment, a critical mass of willing early adopters, a considerable talent pool, a strong domestic market and underserved neighboring markets. Yet, currently only 6 out of 100 people are entrepreneurs – a very low rate given the country’s level of development. What challenges does Turkey need to address in order to unleash entrepreneurship as a force for economic growth?

Endeavor Turkey has

identified many obstacles, including the high costs of navigating the

inefficient and inconsistent bureaucracy, the difficulty in protecting

intellectual property rights, and monopolistic marketplace dynamics in

which dominant players abuse smaller suppliers. It is also difficult to

hire and fire in Turkey. According to the World Bank’s Doing Business

indicators, Turkey ranks among the most difficult countries in this

regard (143 out 183 countries). Then there is the problem of limited

access to capital. For Turkey’s youth, entrepreneurship seems like a

pipedream given this financial limitation. Accordingly, Endeavor’s

entrepreneurship experts recommend that the government launch

alternative capital markets, incentivize small business lending and

enact regulatory reform labor laws (to allow for part-time, flex-time

and long-term consultants).

Endeavor Turkey has

identified many obstacles, including the high costs of navigating the

inefficient and inconsistent bureaucracy, the difficulty in protecting

intellectual property rights, and monopolistic marketplace dynamics in

which dominant players abuse smaller suppliers. It is also difficult to

hire and fire in Turkey. According to the World Bank’s Doing Business

indicators, Turkey ranks among the most difficult countries in this

regard (143 out 183 countries). Then there is the problem of limited

access to capital. For Turkey’s youth, entrepreneurship seems like a

pipedream given this financial limitation. Accordingly, Endeavor’s

entrepreneurship experts recommend that the government launch

alternative capital markets, incentivize small business lending and

enact regulatory reform labor laws (to allow for part-time, flex-time

and long-term consultants).

Perhaps most difficult to change, as is often the case around the world, is culture. Although entrepreneurs “by necessity” are generally respected for their work ethic, entrepreneurs “by choice” who have other promising career options are often discouraged by their families. High-impact entrepreneurs are admired but considered “lucky.” In addition, the absence of a “win-win” social and business culture undermines entrepreneurship and innovation. Thus, Turkey is in as much need for cultural capital as financial capital.

Reinventing the Business Plan, Funding Roadmap Sets a New Industry Standard in the Clouds.

"I've seen thousands of information technology innovations," said Richard Caruso, "and as an Ernst and Young 'Entrepreneur of the Year,' an annual competition judge, creative finance entrepreneur, and developer of Mentorsphere, I review countless executive summaries and business plans. Through this process I've encountered probably every variation in business plan templates, formats, technologies, and technical service providers. Unismart Capital Software's Funding Roadmap Business Plan and Due Diligence Reporting System is a standardized, focused plan development approach and I see it as having the potential to become the next basis for business planning, due diligence, and collaboration.

"I've seen thousands of information technology innovations," said Richard Caruso, "and as an Ernst and Young 'Entrepreneur of the Year,' an annual competition judge, creative finance entrepreneur, and developer of Mentorsphere, I review countless executive summaries and business plans. Through this process I've encountered probably every variation in business plan templates, formats, technologies, and technical service providers. Unismart Capital Software's Funding Roadmap Business Plan and Due Diligence Reporting System is a standardized, focused plan development approach and I see it as having the potential to become the next basis for business planning, due diligence, and collaboration.  I look forward to working with Ruth Hedges and the entire PELT100 Pilot Project UnleashPA with the Innovation America team, as we incorporate all of the revolutionary technology provided by www.Mentorsphere.com, www.Fundingroadmap.com, and the Adreamz Institute.”

I look forward to working with Ruth Hedges and the entire PELT100 Pilot Project UnleashPA with the Innovation America team, as we incorporate all of the revolutionary technology provided by www.Mentorsphere.com, www.Fundingroadmap.com, and the Adreamz Institute.”

The Funding Roadmap is setting a new industry standard with their reinvention of the business plan. Ruth Hedges, Unismart Capital Software CEO says, “We realized the limitations of the business planning model, looked at the accelerating social networking environment, and the lights went on!” Now the Funding Roadmap is being promoted by the Intuit Small Business Community, the SBDCNet and Start-up Weekend, whose founders Marc Nager and Clint Nelson are enthusiastic: “Here is an awesome way to collaborate with your peers while aligning your strategy, setting goals and finalizing your vision.” Users are now located in countries around the world.

From Hype to Reality – Not All Algae Are Created Equally

Algae biofuels are often considered one of those technologies --- like hydrogen fuel cells --- that are always "ten years away." Well, one company says it might have just cracked the code and could be supplying lots of algae jet fuel and diesel in the coming years.

In the race for algae biofuel commercialization, people usually compare open ponds with photobioreactors. Solazyme, however, bypasses photosynthesis (and conventional wisdom) by growing algae in dark fermentation tanks.

Grow algae in dark tanks?! Isn't that like putting solar panels on the dark side of the moon?!

Algae biofuels are often considered one of those technologies --- like hydrogen fuel cells --- that are always "ten years away." Well, one company says it might have just cracked the code and could be supplying lots of algae jet fuel and diesel in the coming years.

In the race for algae biofuel commercialization, people usually compare open ponds with photobioreactors. Solazyme, however, bypasses photosynthesis (and conventional wisdom) by growing algae in dark fermentation tanks.

Grow algae in dark tanks?! Isn't that like putting solar panels on the dark side of the moon?!

Creative Economy Marketing

For several years there has been growing consensus among economic developers about the importance of the creative economy, and many organizations have sprung up to examine and promote its concepts. In Canada, for example, the Creative City Network of Canada (www.creativecity.ca) offers many kinds of resources to municipal staff and the recent annual conference of the Economic Developers Council of Ontario (www.edco.on.ca) was built on the theme of “Defining and Capturing the New Economy,” with Rebecca Ryan, founder of Next Generation Consulting, as the keynote speaker.

For several years there has been growing consensus among economic developers about the importance of the creative economy, and many organizations have sprung up to examine and promote its concepts. In Canada, for example, the Creative City Network of Canada (www.creativecity.ca) offers many kinds of resources to municipal staff and the recent annual conference of the Economic Developers Council of Ontario (www.edco.on.ca) was built on the theme of “Defining and Capturing the New Economy,” with Rebecca Ryan, founder of Next Generation Consulting, as the keynote speaker.

In the US, preparations are under way as this is written for the third annual Creative Cities Summit to be held April 7-9 in Lexington, KY. Another thought-leadership organization, the Seattle-based International Regions Benchmarking Consortium http://www.internationalregions.org, released a report in December 2009 confirming that the springboard for economic growth these days is talent, not industrial resources or infrastructure.

The report, A Tale of 10 Cities: Attracting and Retaining Talent, lays out the typical growth pattern in the creative economy: “A region begins by attracting capable people though existing employers, its university system and an attractive local lifestyle. A growing talent pool then attracts new employers who seek a skilled workforce. This growth in knowledge-based industries, in turn, attracts even more well-educated and skilled people, and so on.

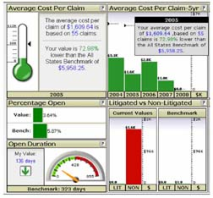

Is a National Dashboard for Open Data on the Horizon?

Sunshiny days have come to government, as transparency Web sites, iPhone apps, online dashboards and data feeds have proliferated across the Internet. The movement is changing the playing field for how citizens obtain government information. Since President Barack Obama made transparency and open data early priorities of his administration, public agencies have put thousands (if not millions) of data sources online, creating a rich pool of material that once was hidden in dusty file cabinets and available only through freedom-of-information requests.

Sunshiny days have come to government, as transparency Web sites, iPhone apps, online dashboards and data feeds have proliferated across the Internet. The movement is changing the playing field for how citizens obtain government information. Since President Barack Obama made transparency and open data early priorities of his administration, public agencies have put thousands (if not millions) of data sources online, creating a rich pool of material that once was hidden in dusty file cabinets and available only through freedom-of-information requests.

Although most agree that openness is a welcome aim, this newfound abundance of data has spawned new questions and challenges: Can government agencies link together these far-flung data sources coherently so that citizens can find what they're looking for? And can open data be packaged and presented in a manner that decision-makers and the public can use to affect policymaking?

Both Sides of the Table

This is part of my

series on Understanding Venture Capital. I’m writing this

series because if you better understand how VC firms work you can better

target which firms make sense for you to speak with.

This is part of my

series on Understanding Venture Capital. I’m writing this

series because if you better understand how VC firms work you can better

target which firms make sense for you to speak with.

It is not uncommon to see a VC talk about “total assets under management” as in “We have $1.5 billion under management.” I don’t really understand why VCs do this since it’s mostly a meaningless number. I’m writing this post to explain to entrepreneurs what you should be thinking about in terms of the VC’s you approach and the size and stage of their funds.

What is total assets under management? - VC’s often talk about this term as in the total amount of funds EVER raised by that VC. Example: if a VC is on their fourth $200 million fund that they just raised in 2009 then you might hear them talk about $800 million under management. This is ONLY relevant in so much as it will tell you that they’ve been able to raise a lot of money historically. But without knowing whether they had a $700 million fund and now have a $100 million fund or whether they’re a first time fund of $800 million it’s pretty meaningless. It’s also meaningless if they had four $200 million funds and the last one they closed was in 2000.

Six Shocks of Entrepreneurship

There’s nothing like a tough economy – and unemployment – to encourage people to take the plunge and open their own businesses. Some have more business experience than others. Some have more education than others. When I started my company, I went through a series of surprises and shocks and the occasional nightmare. With all of the recent interest in entrepreneurship, I thought I would highlight six warning signs that you are about to be broadsided by one of the classic and inevitable struggles of business ownership. If you hear yourself saying these words, take a step back and think about what you’re doing. My hope is that by being more aware you will be better prepared.

There’s nothing like a tough economy – and unemployment – to encourage people to take the plunge and open their own businesses. Some have more business experience than others. Some have more education than others. When I started my company, I went through a series of surprises and shocks and the occasional nightmare. With all of the recent interest in entrepreneurship, I thought I would highlight six warning signs that you are about to be broadsided by one of the classic and inevitable struggles of business ownership. If you hear yourself saying these words, take a step back and think about what you’re doing. My hope is that by being more aware you will be better prepared.

1. “Where’s all the business from our marketing launch?” Marketing can be very expensive, and it is difficult to know what will work. It can propel your company, or it can have minimal or no impact. There will be no shortage of people looking to take your money to help you with your advertising and marketing. The people who sell advertising are usually not marketing experts — they’re salespeople. It is their job to sell. It is your job to be discerning. If you can, test before you invest.

2. “The accountant must be wrong! We must be making money! We’re so busy I can hardly keep up.” You can’t just be a salesperson. You need to do the math. It’s about margins, cost accounting and discounting. It is about the bottom line, not the top line. Plenty of people are very busy right up until the day they run out money. Accounting can be exciting — exciting like finding out you are going broke, or exciting like driving a big profit.

Entrepreneurship After Retirement – What’s Age Got to Do With it?

No longer are the rigors of entrepreneurship meant only for the young and restless. Youthful energy has been dethroned by experience and pragmatism. Increasingly, senior citizens close to retirement are trying their hand at small businesses and making their mark too. So if you think you’re past it…take heart!

Why the surge in the number of older people turning entrepreneurs, one might ask. The reasons are not too hard to guess…..

Security: Senior citizens look for financial security as they approach retirement. Starting their own enterprise gives them the kind of security that a hot-shot job with a mega corporation does not guarantee anymore.

Camp-like “accelerator” programs are the new startup incubators

In the bad old dotcom days, startups used to be hatched in incubators — idea factories that spewed out companies to meet the ’90s bull market’s demand for tech stocks. (The most famous one, Idealab, was once valued at $8 billion.) Now there’s a new kind of startup booster: the accelerator, a camp-like program that brings entrepreneurs together to benefit from both mentors and peers.

In the bad old dotcom days, startups used to be hatched in incubators — idea factories that spewed out companies to meet the ’90s bull market’s demand for tech stocks. (The most famous one, Idealab, was once valued at $8 billion.) Now there’s a new kind of startup booster: the accelerator, a camp-like program that brings entrepreneurs together to benefit from both mentors and peers.

Accelerators have proliferated recently, bringing more opportunities to entrepreneurs who need guidance as much as money. But the sector’s growth means picking one is no longer a simple choice. And now’s the season when many of them start taking applications (including my own accelerator, Capital Factory). How do you choose?

Each program has its own flavor, and no two are really alike. One key consideration: location. Accelerator participants must pick up and move, at least temporarily, to the program’s home base. (Face time is the whole point, after all.) So think about the city in which each program is located. Does it fit your style?

Report: First Quarter of 2010 Sees Record High Venture Capital Deals in Clean Tech

San Francisco — Clean technology

venture capital investments in North America, Europe, China and India

during the first quarter of 2010 totaled $1.9 billion — a record high —

according to statistics just released by The Cleantech Group and

the financial advisory and accounting firm Deloitte.

San Francisco — Clean technology

venture capital investments in North America, Europe, China and India

during the first quarter of 2010 totaled $1.9 billion — a record high —

according to statistics just released by The Cleantech Group and

the financial advisory and accounting firm Deloitte.

One hundred eighty companies in the clean technology and smart grid sectors obtained venture capital financing during the most recent quarter, with new transportation and energy efficiency being the largest two recipients of VC investment by sector, according to the report.

There were 13 initial public offerings of clean technology companies during the quarter, raising a total of $1.5 billion, which was a decrease from the $2.9 billion raised by clean technology firms in their initial public offerings during the fourth quarter of 2009. The largest single IPO of a clean technology business during the most recent quarter was that of Sensata Technologies, a Dutch producer of sensors and controls for solar panels and alternative fuel vehicles, which raised $569 million in its IPO on the New York Stock Exchange.

Can VC’s Invest Across Two Funds?

This is part of a series that I’ve [been working on called Understanding Venture Capital.

This is part of a series that I’ve [been working on called Understanding Venture Capital.

In one of the posts I spoke about how the size and vintage of funds might affect you when you’re raising money. This led Roy Rodenstein (whose company Going.com was sold to AOL) and others to discuss, what happens when VC’s need to invest across multiple funds. Specifically Roy commented

“your company may go long enough that its vintage fund gets cramped and you may get painted into a corner for followons. Even more complicated, VCs often invest from multiple funds or sub-funds into a single deal. So as an entrepreneur it’s hard to navigate those waters over time. As usual the rule is, if you’re doing well, they’ll find the money for your next round.”

Everything that Roy mentions is true. And VC’s don’t like to invest across multiple funds. I thought I’d do a quick post on why VC’s don’t like to cross funds so entrepreneurs can better understand the situation and how to talk with their investors about it.

Making Business Plans Easy : The One Page Business Plan

Is there anything more frightening to a business owner than this

question: “Do you have a business plan?”

Is there anything more frightening to a business owner than this

question: “Do you have a business plan?”

Well, not having enough money to pay your bills, or getting threatened by legal actions are also frightening. But since I’m reviewing “The One Page Business Plan for Women in Business,” I’ll stick with the first example.

Let’s deal with the elephant in the room first. If we’re not approaching someone for financing, do we really need a business plan?

The short answer is yes. Every business should have one. And I would say, as would the authors of this book, that for most businesses, the one page business plan is sufficient.

I [Margie Zable Fisher] was sent this book by one of the authors, Tamara Monosoff, who has written several other great books for women business owners. This time she teamed up with “One Page Business Plan” expert Jim Horan to create a book specifically for women in business.

Start-Ups, Not Bailouts

Here’s my fun fact for the day, provided courtesy of Robert Litan, who directs research at the Kauffman Foundation, which specializes in promoting innovation in America: “Between 1980 and 2005, virtually all net new jobs created in the U.S. were created by firms that were 5 years old or less,” said Litan. “That is about 40 million jobs. That means the established firms created no new net jobs during that period.”

Here’s my fun fact for the day, provided courtesy of Robert Litan, who directs research at the Kauffman Foundation, which specializes in promoting innovation in America: “Between 1980 and 2005, virtually all net new jobs created in the U.S. were created by firms that were 5 years old or less,” said Litan. “That is about 40 million jobs. That means the established firms created no new net jobs during that period.”

Message: If we want to bring down unemployment in a sustainable way,

neither rescuing General Motors nor funding more road construction will

do it. We need to create a big bushel of new companies — fast. We’ve

got to get more Americans working again for their own dignity — and to

generate the rising incomes and wealth we need to pay for existing

entitlements, as well as all the new investments we’ll need to make. It

was just reported that Social Security this year will pay out more in

benefits than it receives in payroll taxes — a red line we were not

expected to cross until at least 2016.

Message: If we want to bring down unemployment in a sustainable way,

neither rescuing General Motors nor funding more road construction will

do it. We need to create a big bushel of new companies — fast. We’ve

got to get more Americans working again for their own dignity — and to

generate the rising incomes and wealth we need to pay for existing

entitlements, as well as all the new investments we’ll need to make. It

was just reported that Social Security this year will pay out more in

benefits than it receives in payroll taxes — a red line we were not

expected to cross until at least 2016.

But you cannot say this often enough: Good-paying jobs don’t come from bailouts. They come from start-ups. And where do start-ups come from? They come from smart, creative, inspired risk-takers. How do we get more of those? There are only two ways: grow more by improving our schools or import more by recruiting talented immigrants. Surely, we need to do both, and we need to start by breaking the deadlock in Congress over immigration, so we can develop a much more strategic approach to attracting more of the world’s creative risk-takers. “Roughly 25 percent of successful high-tech start-ups over the last decade were founded or co-founded by immigrants,” said Litan. Think Sergey Brin, the Russian-born co-founder of Google, or Vinod Khosla, the India-born co-founder of Sun Microsystems.

URBAN TALENT POACHING – A SMALL TOWN RURAL WAY OF LIFE COMES TO AN END OR THE MAKING OF RURAL GHOST TOWNS

Even with Herculean efforts of small rural communities to keep “their spot on the map” by trying to retain the young most highly educated youth, the siphoning of human and social capital necessary to sustain smaller rural communities to more urban locations will continue to incrementally neuter economic and civic sustainability of smaller rural communities.

Even with Herculean efforts of small rural communities to keep “their spot on the map” by trying to retain the young most highly educated youth, the siphoning of human and social capital necessary to sustain smaller rural communities to more urban locations will continue to incrementally neuter economic and civic sustainability of smaller rural communities.

New population growth will be necessary to sustain rural community institutions and infrastructure. New residents must come from urban “transplants”, foreign immigration and an increased native population “birth rate”.

Without this remedy – significant population infusion – modern era ghost towns will take the place of many American small town rural communities.

Our rural education system sponsors and contributes to this trend,

according to Patrick J. Carr and Maria J. Kefalas authors of Hollowing

Out the Middle – The Rural Brain Drain and What it means to America.

Techies, designers, entrepreneurs talk about what they've learned from Apple

For this Sunday's Globe column, I spoke with (and e-mailed with) about fifteen techies, designers, entrepreneurs, and executives around Boston. Rather than talking specifically about the way-too-ballyhooed iPad, I asked them what lessons — positive and negative — they've learned from Apple and Steve Jobs.

- Antonio Rodriguez, venture capitalist at Matrix Partners and founder of Tabblo

- Edward Boches, chief creative officer at Mullen, the Boston marketing agency

- Avid Technology founder Bill Warner

- Harvard Business School professor and author Rosabeth Moss Kanter

- Harry West and Ed Milano of the West Newton design firm Continuum

- OfficeDrop chief executive Prasad Thammineni

- Philip Greenspun, entrepreneur, MIT instructor, flight school owner

- Vijay Kailas, founder of the start-up Numote

7 Technology Transfer Officer Tips For Tough Economic Times

There is no doubt that these are tough economic times. Unemployment is high and credit is tight. Key indicates show that is the worse economy in a generation. Many technology transfer offices have seen potential business partners reduce their innovation portfolios and expenditures. This coupled with a reduction in funding sources, from grants and investors to university sources are blowing the technology transfer research commercialization efforts into the perfect storm.

There is no doubt that these are tough economic times. Unemployment is high and credit is tight. Key indicates show that is the worse economy in a generation. Many technology transfer offices have seen potential business partners reduce their innovation portfolios and expenditures. This coupled with a reduction in funding sources, from grants and investors to university sources are blowing the technology transfer research commercialization efforts into the perfect storm.

There are difficulties and challenges, but these times also create opportunities. Here are seven tips to help your technology transfer office succeed in these tough economic times.

1. Maintain a list of problems that are relevant to the research and technologies in the pipeline.

Technology transfer offices typically get involved in research commercialization efforts late in the research and testing process. Get involved earlier in the process and start developing a list of problems of which the research can be applied.

The arrival of the iPad in pictures – Part 2

At 8.35am, the Apple staff counted down to the dropping of the black curtain, which had shrouded the store windows. As it got closer to 9am and the opening of the doors, the excitement of the crowd was tangible.

Domestic Migration Tales: Who's moving in and Where are They coming From?

The morning survey of news items yielded a find that inspired me to revisit all the recent articles I've collected about migration. Albeit pre-Great Recession, deconstructing

the rush to Atlanta:

The morning survey of news items yielded a find that inspired me to revisit all the recent articles I've collected about migration. Albeit pre-Great Recession, deconstructing

the rush to Atlanta:

This week the Atlanta Regional Commission released one of its periodic Regional Snapshots -- the topic was "Domestic Migration: Who's Moving In and Where Are They Coming From?" The snapshot looked at the 20-county greater metro area that includes Coweta County from 2000 through 2007. The source of the report was IRS tax records. That makes the report somewhat skewed because everyone does not file a tax return, but the report is a good indicator of where people are coming and going.The first revelation is that most moves are local. In fact, 52.1 percent of the people on the move in metro Atlanta moved from one of the 20 counties within the region. Slightly more than 37 percent of those moving to the region came from a different state. And 7.5 percent moved from another county in Georgia outside the 20-county region. Other migration made up slightly more than 3 percent of the incoming population.