More People Go With Visa - Silicon Valley has long depended on immigrant entrepreneurs for new ideas, but there is a dearth of H1-B visas, which allow educated foreign professionals to work in the U.S. To open the doors to more founders who want to found technology start-ups, a group of tech investors is proposing that lawmakers adopt the “Startup Visa” that would enable VC-sponsored entry to the U.S. for two years. The idea appears to be a spinoff of Paul Graham’s proposal in April for a “Founders Visa” for 10,000 foreign start-up founders. The Wall Street Journal’s article on the Startup Visa mentions that this would be for technology entrepreneurs, though I’m guessing it would also have to address founders of other companies in the life sciences and clean technology spaces. As Mark Heesen, president of the National Venture Capital Association, wrote in The New York Times last year, there is too much focus on how immigration policy affects high-skilled workers in the information technology sector, but the new battle is in life sciences and clean technology, with many experts in those fields now residing abroad after being educated in the U.S.

This morning’s roundup of the latest venture capital news and analysis across the Web:

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

My Recommendation: Stop Making Design Recommendations

It’s easy to believe them when clients ask us, designers, to make recommendations. We want to believe they love us for our wisdom, knowledge, and experience. They want our advice. And we love giving them advice. It makes us feel smart—like they finally “get” what we’re about. They want to do the right thing and we know how to help them. So, why is it bad to make design recommendations? They want it. We want it. Why shouldn’t we make the recommendations they’re asking us to give?

Simple: The recommendations don’t work. We end up looking bad. Clients lose faith in our skills. And the design doesn’t get better. Interestingly, in our research, the best teams don’t use recommendations. Instead they use an experimentation approach.

Judges to pick Pipeline's top innovator of year [The Wichita Eagle, Kan.]

Jan. 7--A Wichitan, a software- giant executive and the son of oilman T. Boone Pickens are among the judges of Pipeline's Innovator of the Year competition to be held Jan. 21 in Overland Park.

The judges are Rich Bendis, president and CEO of Innovation America in Philadelphia and former CEO of the Kansas Technology Enterprise Corp.; John Pavetto of Wichita, chief information officer of Koch Industries; Tom B. Pickens III, CEO of Astrotech in Austin, Texas; Cliff Reeves, general manager of Microsoft's emerging business team in Silicon Valley, Calif.; and Bill Sanford, CEO of Symark in Cleveland and a board director of the Kansas Bioscience Authority.

Grants aim to boost agricultural innovation

Eleven agriculture innovators will share $225,500 in grants for projects designed to strengthen, build or restore sectors of the Wisconsin agricultural industry.

The Agricultural Diversification and Development Grants build on the state’s efforts to encourage innovation and diversity in agriculture, Wisconsin’s signature industry.

“Agriculture is the backbone of Wisconsin’s economy and these innovative projects ensure that agriculture will drive our state economy for years to come,” Gov. Jim Doyle said. “These grants build on Wisconsin’s nation-leading agricultural diversity by encouraging investment, growing jobs and creating new products.”

Intel Joins Obama’s $500 Million Math, Science Push (Update1)

Jan. 6 (Bloomberg) -- President Barack Obama said Intel Corp. is part of a public-private partnership contributing more than $250 million to a government program aimed at boosting math, science and technology education.

The money is targeted for training teachers in those subject areas and builds on an initiative the administration announced in November.

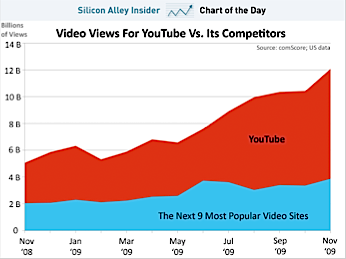

CHART OF THE DAY: YouTube's Staggering Growth Continues

YouTube is still smashing the rest of the Web video industry, at least when it comes to how many videos people watch every month.

The latest data from comScore says YouTube served 12 billion video views during November, up 137% year over year. Unique visitors to the site are strong as well, up 32%.

Energy Innovation Hubs To Focus On 3 Areas

Research on energy from sunlight, energy efficiency in buildings and advanced nuclear reactors is the focus of Energy Innovation Hubs that will be created and funded by the U.S. Department of Energy.

On Dec. 22, DOE announced plans to invest as much as $366 million in starting and operating the new energy research centers. The three DOE Energy Innovation Hubs will conduct research on the production of fuels directly from sunlight, improving energy-efficient building systems design, and computer modeling and simulation to be used for advanced nuclear reactors.

Green Innovation

A panel of experts discuss how businesses can work toward sustainability.

In April 2009, Forbes hosted a panel discussion about sustainability and as part of our Business Visionary series. Strategy & Innovation editor Renee Hopkins recently re-convened the panel to explore the topic further. The participants include Andrew Shapiro, CEO of strategy consulting firm GreenOrder; Lewis Perkins, Sustainable Strategist for the Mohawk Group; and Mark Johnson, co-founder and chairman of Innosight.

Strategy & Innovation: I'm struck by the differences and similarities between existing companies like yours, Lewis, trying to move in the green direction, and companies like the ones you describe in your article, Mark, and the ones you work with, Andrew, that are trying to formulate new business models around sustainability, or clean-tech, or both. Let's talk about the start-ups first. If you're a "green" start-up right now, what's the most critical issue or issues facing you?

As ’10 begins, think about investment capital

Seed capital attracts other private investment. It stimulates new companies which create new jobs. New jobs create wealth, which in turn creates more jobs.

The inverse is also true. Without the availability of seed capital, there cannot be a robust innovation economy. It just won’t happen.

And that’s been the challenge in Oklahoma. The Oklahoma Department of Commerce and the Greater Oklahoma City Chamber of Commerce have conducted studies verifying the need for seed capital dating as far as 1997.

In 2007, the Oklahoma Seed Capital Fund I, an innovative private/public partnership, was created.

How Google Is Becoming A Media Company

A little over a year ago, on Dec. 1, 2008, I [Simon Dumenco] made this prediction in my column: "Google will buy Yelp" -- the social-networking-esque site that provides user-written reviews of businesses in cities across the U.S. and Canada. It took a while, but Google finally tried to make good on my prediction last month -- but, of course, failed (at least initially). Yelp reportedly balked at being bought. Then Miguel Helft of The New York Times Bits blog reported that his source was saying that Google walked away from the acquisition talks, because it "didn't want to let the negotiations be driven by leaks to the press." In other words, Google was pissed at Yelp for driving a hard bargain. (If only Google had moved earlier -- like in December 2008! -- before Yelp got so full of itself.)

Biodesign Institute appoints operations director

Lee Cheatham has accepted the position of operations director at the Biodesign Institute at Arizona State University. He also will serve as general manager of the Biodesign Impact Accelerator, a new initiative that will dramatically accelerate the commercial translation of scientific innovations and technologies generated by the institute. Cheatham is currently the executive director of Washington Technology Center in Seattle.

In his role as operations director, Cheatham will oversee a number of administrative functions, including security, facilities, health/safety and information technology. In his role as general manager of the Biodesign Impact Accelerator, he will be responsible for program development and oversight of all operations for the Impact Accelerator.

Dept. of Commerce: Secretary Leinenkugel seeks Wisconsin partners for National Entrepreneurship Week 2010

MADISON – The fourth annual recognition of National Entrepreneurship Week (NEW) occurs February 20 through February 27, 2010. Sponsored by the National Consortium for Education Excellence, National Entrepreneurship Week is a celebration of American entrepreneurs and the educational programs currently preparing youth to develop a passion toward entrepreneurship as a viable career option.

“Last year, organizations hosted events that celebrated the power of entrepreneurship throughout Wisconsin,” said Department of Commerce (Commerce) Secretary Richard J. Leinenkugel. “Once again, we’d like to encourage state and local government, schools, nonprofit organizations, entrepreneurs and community leaders to observe the week by hosting events.”

The focus of this fourth year’s celebration includes the celebration of Wisconsin’s entrepreneurs and the lifelong learning educational opportunities that prepare the NEW business leaders of the future. Organizations will find resources to support their event and program planning on the National Consortium for Education Excellence web site at http://www.nationaleweek.org/.

Breakthrough of the Year: Ardipithecus ramidus

A rare 4.4-million-year-old skeleton has drawn back the curtain of time to reveal the surprising body plan and ecology of our earliest ancestors.

Only a handful of individual fossils have become known as central characters in the story of human evolution. They include the first ancient human skeleton ever found, a Neandertal from Germany's Neander Valley; the Taung child from South Africa, which in 1924 showed for the first time that human ancestors lived in Africa; and the famous Lucy, whose partial skeleton further revealed a key stage in our evolution. In 2009, this small cast got a new member: Ardi, now the oldest known skeleton of a putative human ancestor, found in the Afar Depression of Ethiopia with parts of at least 35 other individuals of her species.

Ever since Lucy was discovered in 1974, researchers wondered what her own ancestors looked like and where and how they might have lived. Lucy was a primitive hominin, with a brain roughly the size of a chimpanzee's, but at 3.2 million years old, she already walked upright like we do. Even the earliest members of her species, Australopithecus afarensis, lived millions of years after the last common ancestor we shared with chimpanzees. The first act of the human story was still missing.

Kentucky Helps High Tech Firms

Capital is needed to help high tech firms grow since product development can be expensive and it may be difficult to raise private investment funds. The state of Kentucky provides assistance to help high tech companies find funds and opportunities.

Governor Beshear recently announced that five Kentucky high tech companies will share over $1.3 million in state funds as part of a Kentucky initiative to attract and support technology-based small businesses located in the state. The state of Kentucky helps companies by matching up to $100,000 for SBIR awards for either a Phase I award or up to $500,000 per year for up to two years for a Phase II award. If a single company receives both a Phase I and Phase II award, that company can receive up to $1.1 million.

Bringing New Ideas to Market

Knowledge Transfer, Open Innovation, and the Role of Federal Agencies and Universities in U.S. Economic Competitiveness

When the White House communicates to federal agencies about science and technology policies for the 2011 budget, as Office of Management and Budget director Peter Orszag and Office of Science and Technology Policy director John Holdren did this past August, the agencies take such guidance seriously. This year the guidance focused on the outcomes of research, not on the research agenda itself. Specifically, the OMB and OSTP directors raised four practical challenges:

* “Applying science and technology strategies to drive economic recovery, job creation and economic growth”

* “Promoting innovative energy technologies”

* “Applying biomedical science and information technology to help Americans live longer, healthier lives, while reducing health care costs”

* “Assuring we have the technologies needed to protect our troops, citizens, and interests.”

Funding Innovation

Via Tyler Cowen, comes this graph of demographic shifts in NIH grants, which show a clear trend: older scientists are getting more money.

Cowen also cites the eminent economist Paul Romer, who worries about the effect of this shift on innovation:

Instead of young scientists getting grant funding to go off and do whatever they want in their twenties, they're working in a lab where somebody in his forties or fifties is the principal investigator in charge of the grant. They're working as apprentices, almost, under the senior person. If we're not careful, we could let our institutions, things like tenure and hierarchical structures and peer review, slowly morph over time so that old guys control more and more of what's going on and the young people have a harder and harder time doing something really different, and that would be would be a bad thing for these processes of growth and change. I'd like to see us keep thinking about how we could tweak our institutions to give power and control and opportunity to young people.The bad news is that Romer is right, at least in part: young scientists, in general, tend to be a bit more innovative. (If you noticed all the conditionals and hedges in that sentence, please keep on reading.) The ingenuity of youth is perhaps best demonstrated by the inverted U curve of creative output, a well-studied phenomenon in which creativity rapidly increases at the start of a career before it crests and declines. Here's Dean Simonton, a psychologist at UC-Davis who has painstakingly quantified this demographic data:

EIGHT CREATIVE ACTIONS FOR MORE SUCCESS

Happy New Year to all readers of "Creativity Un-Ltd", and welcome to the Twenty Tens. The majority of business gurus and futurists agree that in the coming decade, innovation and creativity will decide more than ever which companies and individuals will thrive in business. How can you succeed in the "Era of Ideanomics" (the phrase coined by Alan Greenspan)? Follow these eight creative tips to flourish in the innovation economy.

1. Ideate more. Whenever you face a tough challenge and need ideas on how to resolve the situation, start by formulating the issue as a "How to?" sentence ("How to get more creative to succeed in the 2010s?") and then jot down at least 25 ideas. "When you write down your ideas you automatically focus your full attention on them. Few if any of us can write one thought and think another at the same time. Thus a pencil and paper make excellent concentration tools," as the US business author Michael Leboeuf noted. If the problem relates to your business, ask your team members to do the same, and then kick off a brainstorming session where you generate more ideas (and hit an idea quota of 200-300 ideas).

A single patent can wait, Europe's priority should be more patent attorneys

Back in September 2009 I [Author] wrote a blog that stated the best way to get European SMEs to engage withthe patent system is to ensue there are more patent atorneys out there looking for their custom. It provoked quite a few responses. In the most recent issue of the CIPA Journal, published by the UK's Chartered Institute of Patent Attorneys, I have written a longer opinion piece that expands on the points I made back in September. For those who do not get the Journal, here it is ...

There is no doubt that EU politicians were very pleased with themselves after voting to approve the principle of a unitary European patent system on 4th December in Brussels. "This business-friendly deal will make patenting and innovating easier and more affordable for British companies. In particular, innovative SMEs will have more flexibility when choosing how to patent across Europe," said the UK's IP minister David Lammy. "Establishing an EU patent and a single European Patent Court is the single most important measure for promoting innovation in Europe. In view of the major simplifications and cost savings, this is, of course, also particularly important for small and medium-sized enterprises," said Sweden's Minister for Justice Beatrice Ask.

Helsinki - Business Angels and the Innovation train

Early Warning Note to Business Angels. The innovation train is on the move. The symbolic journey Helsinki – Oulu – Helsinki will take place 13.1.2010 and we hope to have some disruptive open innovation news released during or after the trip.

There is talk about the documentation of the trip. Blogs, podcasts, Flicker, video streams, YouTube, Qik, Facebook, Brightkite, Qaiku, Twitter, Bambuser, Ning, etc will tell about details.

The www.collect.fi is the official home page and the core content will certainly be translated to English after the trip.

Why Do VCs Blog (and Tweet)?

For decades, the venture capital industry was like a Yale Secret Society—very clubby, discrete, and opaque. VCs had all the power in the VC-entrepreneur equation, and entrepreneurs had to work hard to decode the mysterious VC process to obtain funding.

My how the world has changed in a few short years.

Pundits will tell you that in terms of trends, 2009 was the year of the real-time Web/Twitter, smart phones/iPhone and the mainstream emergence of digital advertising. But 2009 was also the year VCs blogging and tweeting really became mainstream.