The purpose of this paper is to provide an empirical test of the commercialization route chosen by university scientists funded by the National Cancer Institute (NCI) at the NIH and how their chosen commercialization path is influenced by whether or not the university technology transfer office is involved. In particular, the paper identifies two routes for scientific commercialization. Scientists who select the TTO route by commercializing their research through assigning all patents to their university TTO account for 70% of NCI patenting scientists. Scientists who choose the backdoor route to commercialize their research, in that they do not assign patents to their university TTO, comprise 30% of patenting NCI scientists. The findings show a clear link between the commercialization mode and the commercialization route. Scientists choosing the backdoor route for commercialization, by not assigning patents to their university to commercialize research, tend to rely on the commercialization mode of starting a new firm. By contrast, scientists who select the TTO route by assigning their patents to the university tend to rely on the commercialization mode of licensing.

The purpose of this paper is to provide an empirical test of the commercialization route chosen by university scientists funded by the National Cancer Institute (NCI) at the NIH and how their chosen commercialization path is influenced by whether or not the university technology transfer office is involved. In particular, the paper identifies two routes for scientific commercialization. Scientists who select the TTO route by commercializing their research through assigning all patents to their university TTO account for 70% of NCI patenting scientists. Scientists who choose the backdoor route to commercialize their research, in that they do not assign patents to their university TTO, comprise 30% of patenting NCI scientists. The findings show a clear link between the commercialization mode and the commercialization route. Scientists choosing the backdoor route for commercialization, by not assigning patents to their university to commercialize research, tend to rely on the commercialization mode of starting a new firm. By contrast, scientists who select the TTO route by assigning their patents to the university tend to rely on the commercialization mode of licensing.

innovation DAILY

Here we highlight selected innovation related articles from around the world on a daily basis. These articles related to innovation and funding for innovative companies, and best practices for innovation based economic development.

Top 10 YouTube Videos About Facebook

Facebook runs a website that gets a quarter of a trillion page views per month. The culture around Facebook has led to many popular videos. Some of the most viewed videos about Facebook are simply music videos and many of those didn't make our list.

Facebook runs a website that gets a quarter of a trillion page views per month. The culture around Facebook has led to many popular videos. Some of the most viewed videos about Facebook are simply music videos and many of those didn't make our list.

While we did consider the number of views in our selection, we primarily focused on videos that illustrate all the ways Facebook has changed our lives. From Farmville, to warnings about losing privacy to what people don't like about Facebook, this list of videos shows society's reaction to Facebook's sudden rise in popularity. Also included are two 60 Minutes interviews with Facebook founder Mark Zuckerberg. They're from 2008, back when Facebook only had 10% of the users they have today.

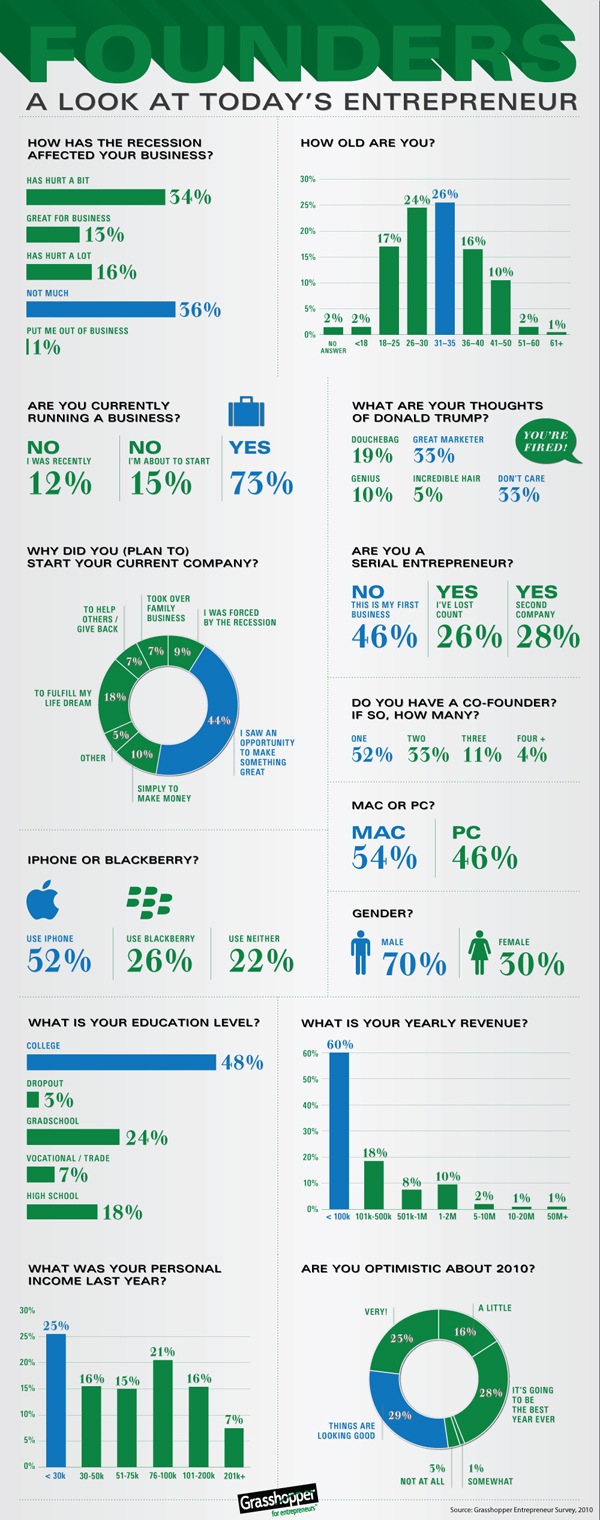

Infographic of the Day: The Entrepreneur's State of Mind in 2010

Recently, the blog Grasshopper conducted a survey, "The Entrepreneur State of Mind," and the results have now been summarized in an infographic by Jason Lankow of Column Five Media.

The picture it paints adds some demographics to a fairly amorphous set of people. As you'd expect, entrepreneurs are largely youngish, broke, hungry--and probably far more optimistic than your average bear. The weirdest thing was that 70% are male. Which sounds like a sampling error, but looking around at today's businesses, it does seem like almost all were started by men:

Problems Create Opportunities: ‘Innovation X’

Innovation is the key to developing new revenue streams, staying competitive and creating jobs. Adam Richardson, creative director at global innovation firm frog design, inc., where he has worked with companies such as HP, Intel, Motorola, Logitech, and Yahoo!, has come out with a new book entitled Innovation X, published by Jossey Boss.

Innovation is the key to developing new revenue streams, staying competitive and creating jobs. Adam Richardson, creative director at global innovation firm frog design, inc., where he has worked with companies such as HP, Intel, Motorola, Logitech, and Yahoo!, has come out with a new book entitled Innovation X, published by Jossey Boss.

Mr. Richardson writes regularly on design and business, and speaks at conferences worldwide. In addition to teaching design and user research, he is a guest lecturer at the Ecole Nationale Supérieure de Création Industrielle in Paris and at the IESE University of Navarra in Barcelona. Mr. Richardson earned his BFA in Industrial Design from the California College of the Arts, and a multi-disciplinary MA from the University of Chicago.

7 Ways To Hone Attention, Insight And Creativity

Back in my [Jonathan Fields] corporate lawyer days, there was one guy who everyone hated. Not because he was mean or underhanded or cut-throat. He was actually quite nice and always willing to help. People hated him because he was good. Superstar good.

While everyone else fretted and froze under the dizzying pace and pressure of the job, he seemed to always keep it together, to thrive and even come alive as the fire got hotter.

He wasn’t an adrenaline junkie or cowboy. He was actually a pretty level-headed guy. But he just seemed to process things faster, do things differently and see things everyone else missed. And that gave him an edge. An edge everyone else wished they had.

I used to wonder what he was doing differently. Whether he was just wired that way. Maybe it was genetic. Or perhaps there was something else going on. All I knew is I wanted an answer.

MENA region nurtures knowledge economy

![]() The Middle East, North Africa region is emerging as a resilient growth market with promises of renewed market growth and technology innovation.

The Middle East, North Africa region is emerging as a resilient growth market with promises of renewed market growth and technology innovation.

The MENA region, extends from Moroco in northwest

Africa to Iran southwest Asia and includes all the Arab Middle East and

North Africa countries, as well as Cyprus, Iran, Israel and Turkey.

According to one recently published report the Middle East and North Africa (MENA) region is seeing a surge in activity aimed at developing develop the knowledge economy and strengthening links between education, research and development (R&D), industry, information and communication technology and entrepreneurship. In school and higher education systems also, greater attention is being paid to vocational training and curricula are being overhauled to upgrade teaching of mathematics and science and to encourage a culture of R&D and innovation.

Five Easy Ways To Shave Business Energy Bills

Five Easy Ways To Shave Business Energy BillsThink “energy efficiency” and high-priced upgrades like replacing the office lights or installing a fancy energy-efficient heating system often spring to mind. In reality, though, many of the most effective energy-saving strategies for small businesses require little or no upfront cost, meaning you can reap real savings almost immediately.

Five Easy Ways To Shave Business Energy BillsThink “energy efficiency” and high-priced upgrades like replacing the office lights or installing a fancy energy-efficient heating system often spring to mind. In reality, though, many of the most effective energy-saving strategies for small businesses require little or no upfront cost, meaning you can reap real savings almost immediately.

Here are five low-cost energy-saving opportunities to consider:

Unplug equipment (or use power strips). Office equipment, battery chargers and electronics continue to draw energy from the electrical outlets even when they’re turned off. This “phantom energy” or “vampire power,” as it’s called, can account for up to 30% of your electricity bills. To prevent that, unplug equipment when it’s not in use. Or if there are too many gadgets to unplug individually, plug everything into a power strip and flip the switch off.

Set the sleep mode on computers, printers and copiers. Most office electronics these days offer a “power-saving” or “sleep” mode. What it does: When the equipment isn’t used for an extended period, it will automatically go into a low-energy-consuming mode. You can simply shake the mouse or hit a button and the equipment springs back to full life. For each computer in your business, setting the power-saving mode on the monitor and system drive can save up to $50 a year on electricity bills. Enabling power-saving modes on copiers or printers can save even more.

Ride the Entrepreneur Rollercoaster

Life is full of ups and downs. If you're an entrepreneur, there are a

whole lot more of them. The ride many entrepreneurs take is so bumpy

that many have dubbed it "the entrepreneur rollercoaster." As you

struggle to launch and grow your business, you'll experience those highs

and lows over and over again, sometimes with the same venture, and most

definitely with each new business you launch. To give you just an idea

of what an entrepreneur goes through, I brought together some resources

to create this animated video, "The Entrepreneur Rollercoaster."

It provides a brief snapshot into what life is like for an

entrepreneur, and how cyclical the process is. Enjoy the ride.

"American Trademarks" Traces the Origins of Our Logo Lust BY Ken CarboneThu Apr 8, 2010

In the year 100,010, some evolved species will be digging through ancient digital rubble and find a strange visual iconography made of tiny colorful squares with rounded corners. They will diligently attempt to decipher what we meant by "I am T-Pain," "Doodle Jump," and "Zombie Farm." Finally, they will conclude that our native tongue was something called Apps.

Every day new apps are introduced for the iPhone, iTouch, and now the iPad (not to mention Android apps). Each represents a new business and the touch-screen icons serve as their "logos." With over 100,000 apps to date and more on the way, this is a creative gold rush for graphic designers and fuels our insatiable lust for designing logos.

Start-ups Have Been Shrinking

The importance of firm formation to net job creation raises the question: Over time, are newly formed businesses employing more or fewer people? Given the number of net new jobs created from firm formation, a decline in startups’ average employment could pose problems for our economy’s ability to generate the jobs we need to reduce current levels of unemployment.

To figure out what has been happening to the initial employment of new businesses, I took a look at data from the Longitudinal Business Database of the U.S. Census (see figure below). The vertical axis measures the average number of employees per new business in its founding year. The blue bars show the average number of employees in new firms by year. The black line shows the five year moving average of that figure.

Creativity & Innovation In Banner Advertising Is Still Alive – Review

Just when I think that something is dead it surprises me with a new way which is creative and comes back to life. Offlate Ive felt that banner advertising is dead. But I guess after today I would say creative banner advertising is rare and not dead. Today I came across a banner ad that I not only interacted with but I am also writing this blog post about it.

I went to Youtube today morning and came across this banner ad (Check screenshot below)

If you click on the above you will know that it asks you to click on the banner. Once you click the attributes given to the girl start changing after she starts having sprite. Check each time you click the banner changes on attribute. At the end she gets her match.

Check how banner looks at the end of 4 clicks:

How High-Tech Cameras Are Changing Baseball Forever

"C hanging the game" is the motto of Sportvision, a company that takes pictures of sporting events.

hanging the game" is the motto of Sportvision, a company that takes pictures of sporting events.

In baseball, at least, Sportvision is doing exactly that.

Sportvision's primary business is selling "enhancements for sports television." The images it captures are used to create neat graphical overlays shown on TV.

But the data Sportvision collects is doing a lot more than that. The company's baseball analytics tools, PITCHf/x, HITf/x, and FIELDf/x, capture the precise flight of the ball and movement of the players at every stage of play, giving teams, analysts, and fans far more information about the game than would have been possible just a few years ago.

Big Misunderstandings about ARRA Stimulus for Clean Energy

A few weeks ago I [Arno Harris] flagged a story in the Christian Science Monitor titled

"Stimulus Funds for Clean Energy Largely Unspent" because I

thought it deserved a clarifying 'blog post. The story repeats several

big misunderstandings about the status of renewable energy

programs included in the American Recovery and Reinvestment Act of 2009

(ARRA). The general thrust of the story is that the lack of immediate

and large uptake of stimulus funds is a sign that the program isn't

working or having its intended result.

The reality is that despite the low outflows of ARRA funds to date, the stimulus program is playing an important role in maintaining business continuity for developers of solar and wind projects in the US. In fact, the expiration of the program at the end of this year poses a major disruptive threat to the progress that's been made in renewable energy in the US over the last few years. It's critical that we get the program extended for a couple more years to enable the industry to recover fully.

ARRA was passed in the early days of the Obama administration as the magnitude of the financial crisis began to unfold. Among its many provisions was a section intended to support continued development of renewable energy projects--particularly wind and solar projects. The provision allows wind and solar developers to receive a cash grant in lieu of the Investment Tax Credit (ITC).

Google CEO says newspapers can make money online

WASHINGTON (AP) -- Google Inc. Chief Executive Eric Schmidt told a group of editors Sunday that he is confident that newspapers will find new ways to make money online by harnessing the vast reach of the Internet.

WASHINGTON (AP) -- Google Inc. Chief Executive Eric Schmidt told a group of editors Sunday that he is confident that newspapers will find new ways to make money online by harnessing the vast reach of the Internet.

Media executives have accused Google of draining readers and advertising from newspapers' Web sites. But in a speech to open the annual conference of the American Society of News Editors, Schmidt said Google recognizes that newspapers are vital to democracy and provide a critical source of online content.

"We understand how fundamental your mission is," he said.

Schmidt predicted that the news business will find a new model, based on a combination of advertising and subscription revenue. He said Google hopes to facilitate that, but he offered no specifics.

Laughing Your Way to the Bank

G![]() o ahead, LOL. A sense of humor is an

under-rated tool for entrepreneurs, innovators, and change agents. And

that's no joke.

o ahead, LOL. A sense of humor is an

under-rated tool for entrepreneurs, innovators, and change agents. And

that's no joke.

To keep the recovery going and put people back to work, imaginative entrepreneurs must start new businesses and revitalize old ones. Creative leaders unlock ingenuity and build support for change by lightening up. They are willing to consider new possibilities that seem absurd, even ludicrous, at first. They shake up thinking as though shaking a kaleidoscope, allowing surprising new juxtapositions to emerge. This is exactly what humor is all about: playing with ideas, challenging assumptions, and poking fun at tradition.

Some entrepreneurs thrive on humor. Monster.com founder Jeff Taylor went on both to start new Internet ventures and crack jokes as a part-time radio disk jockey. Former BBC head Greg Dyke produced a wave of creativity, including development of the BBC hit comedy, The Office, by going to ridiculous extremes that gave others permission to float "silly" (and often successful) ideas. For example, he printed yellow cards resembling penalty cards in European soccer marked "Cut the crap, make it happen" that could be tossed on the table during ponderous meetings.

VC capital surges into China

VENTURE capital and private equity investments in China jumped last month backed by positive investments in information technology industries, an industry report said today.

VENTURE capital and private equity investments in China jumped last month backed by positive investments in information technology industries, an industry report said today.

VC and PE firms invested US$418 million in 46 businesses through March, compared with US$292 million in 18 cases a month earlier, Zero2IPO Research Center said.

Investments in information technology sector totaled US$192 million, accounting for 46.2 percent of the total, in 20 cases, the report said.

NINE NATIONAL ORGANIZATIONS SUPPORTING SMALL BUSINESS AND INNOVATION JOIN TOGETHER ON CONCERNS ABOUT SENATE FINANCIAL REFORM BILL

As national organizations that support the start-up and growth of innovative small businesses, we want to express the importance of ensuring that the Restoring American Financial Stability Act of 2010 does not damage angel investing and particularly the entrepreneurial businesses they support. We join the Angel Capital Association in asking that two small sections in the bill be removed or modified:

- Section 412 and 413, Adjusting the Accredited Investor Standard for Inflation. As currently written, this section could result in the elimination of as many as two-thirds of all accredited investors who invest directly in start-up and early-stage small businesses.

- Section 926, Authority of State Regulators Over Regulation D Offerings. This section could make it more difficult to raise angel capital from investors in different states, make it unclear what entities regulate angel investments, and introduce potential lengthy waiting periods for businesses to receive their capital, possibly resulting in the death of those businesses.

- We appreciate the importance of regulation to protect investors from fraud, but we urge the Senate to consider several factors in improving these sections of the legislation:

- Entrepreneurial companies are important to job creation and innovation in the United States. We note particularly the study by the US Census Bureau that companies five years old or less created all of the net new jobs over a 25 year period.

- Angel investors are an important source of capital for many of these innovative start-ups. For instance, one of the signatories to this letter, the Association of University Technology Managers (AUTM), has tracked the source of initial funding for university spin-out companies for the past five years. They have consistently found that accredited individual investors are the source of initial funding for a third of all university start-up companies. All of the signing organizations are therefore deeply concerned about any changes that would diminish the size of the pool of accredited investors.

- Establishing standards that would significantly cut back on the pool of angel capital is especially difficult during the recession, when small businesses are having trouble finding capital, especially in the $100,000 to $2 million range that is sometimes referred to as the “Valley of Death.”

- Startup and seed investments are precisely the types of financing that need uniformity and simplicity the most. It is important to ensure that entrepreneurs raising capital have the same regulations regardless of their state and that they are not subjected to excessive legal costs, delays, complexity, and uncertainty that would follow from Section 926 as currently written.

- Consider “beefing up” accredited investor protections for private offerings by clarifying who is disqualified from involvement in these financings and developing more accessible information on individuals and entities with prior records of fraud and deceit in any type of investment activity, so that federal and state securities regulators can more easily review Regulation D filings to ensure that new investment offerings do not include those people and entities.

Thanks for your consideration of these issues and your support of innovative small businesses. We want to ensure that the entrepreneurial startups that create important innovations and high quality jobs not only continue to have this important type of capital so they can grow, but that they are not subjected to regulations that make new and existing companies die for lack of capital or waiting to clear 120 day hurdles and large legal costs to get regulatory approval for the legitimate capital they raised.

Sincerely,

Dan Berglund State Science & Technology Institute

Marianne Hudson Angel Capital Association

Jim Jaffe National Association of Seed and Venture Funds

David Monkman National Business Incubation Association

Matthew Nemerson Technology Councils of North America

Rohit Shukla Larta Institute

Ashley Stevens, D. Phil (Oxon), CLP Association of University Technology Managers

Kerwin Tesdell Community Development Venture Capital Alliance

Eileen Walker Association of University Research Parks

Guiding Principles on Open Innovation: Communication - Stefan Lindegaard

I [Stefan Lindegaard] have just attended a great conference by 100% Open which is a new agency specialising in open innovation. They have an interesting Jam & Discover approach to open innovation and they also run networks and extend into training and venturing. Check out their site: 100% Open

I [Stefan Lindegaard] have just attended a great conference by 100% Open which is a new agency specialising in open innovation. They have an interesting Jam & Discover approach to open innovation and they also run networks and extend into training and venturing. Check out their site: 100% Open

At the conference, I picked up a new report: Open innovation – From marginal to mainstream. In this, they had some guiding principles and since I could not find it online I have typed in their guiding principle on communication below as I find it worth sharing. UPDATE: You can read the full report here: NESTA

100% Open Guiding Principle on Communication:

- Many large organisations are trying to become open innovators by first trying to change their culture. Whilst this is rational, it rarely seems to work. Companies will often change their ways of doing things more happily and spontaneously if the see first-hand evidence of colleagues adopting a new approach and it working. Success sells.

IBM Launches Global Entrepreneur Initiative to Help Start-Ups

In today's challenging economic

environment, technology start-ups can struggle to bring new ideas to

market. In response, IBM (NYSE: IBM) opened its resources to these

companies in a new initiative to help this next generation of

entrepreneurs capture emerging business opportunities in fast-growing

industries such as energy and utilities, health care, telecommunications

and government.

In today's challenging economic

environment, technology start-ups can struggle to bring new ideas to

market. In response, IBM (NYSE: IBM) opened its resources to these

companies in a new initiative to help this next generation of

entrepreneurs capture emerging business opportunities in fast-growing

industries such as energy and utilities, health care, telecommunications

and government.

The IBM Global Entrepreneur initiative provides start-ups with no-charge access to industry-specific technologies in a cloud computing environment. Under the new program, IBM will provide access to its Research community as well as sales, marketing and technical skills. IBM invests more than $6 billion per year in Research with more than 3,000 people in eight labs around the world. With more than 4,914 new patents in 2009 alone, IBM has experience bringing innovative technologies to market.

IBM is uniquely positioned to help start-ups because of the depth of resources, expertise, and experience with the most forward-thinking institutions, governments, and businesses around the world. With its Smarter Planet strategy and years of investments in research, IBM is skilled in building product and services offerings for businesses based on new ideas. IBM Industry Frameworks, for example, are software platforms targeted to industry specific market opportunities such as Smarter Water, Smarter Buildings and Smarter Health Care.